Click on the chart to see a larger image!

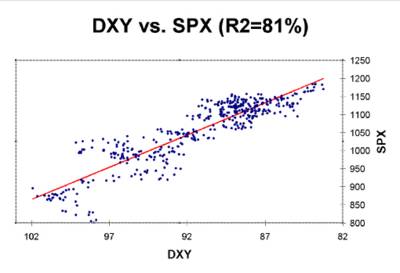

This is the relationship between the stock market and the dollar that I mentioned on Friday. While I see the logic that a falling dollar helps exports and profits at multinationals I am not convinced these factors can offset the interest rate effects. During the late 90's the strong dollar was good for the markets because it was evidence of foreign investment. This made sense because the strong dollar and low interest went together and led to an investment boom.

The dollar is still the world's reserve currency so maybe U.S. interest rates can stay low indefinitely but my guess is that in the very near future U.S. interest rates will head higher. Whether it is because the falling dollar causes inflation or capital flight, I can not say but both pose very real risks. The optimism being exhibited by corporate bond buyers here makes me question whether the capital markets are really prepared for the change.

No comments:

Post a Comment