A posting on an Islamist Web site that said the fugitive militant could die at any time and that Muslims should be prepared. This was taken by some to mean he might actually be dead and was used by some investors as an excuse to cover short equity positions, dealers said.I read some speculation yesterday that President Bush would announce Bin Laden's death or capture in his press conference. Sometimes one rumor starts another.

This is a trading diary containing my views on international financial markets and economic news. I focus on the relationships between bond, currency, commodity and equity markets across countries. All ideas and opinions expressed here are shared for educational purposes. THESE ARE NOT RECOMMENDATIONS!

Apr 29, 2005

Osama Speculation

Renminbi Tests the Air Outside the Band

China's renminbi currency traded briefly outside its tightly controlled band on Friday, triggering a renewed wave of speculation that the government was set to allow a long-expected revaluation.

The People's Bank of China, the central bank, late on Friday blamed the change on "technical problems", with officials speculating a dealer may have keyed in the wrong rate.

In spite of mounting international pressure for China to allow its currency to appreciate, a spokesman for the PBoC said no announcement of a change in policy was planned.

Traders said the renminbi, which has been pegged to the US dollar for a decade, was briefly in the market at a rate of Rmb8.2700 to the dollar, outside of the usual band of 8.2760 to 8.2800.

Traders could not say whether the State Administration for Foreign Exchange, the Chinese government agency which handles currency trades, conducted any business at the higher rate.

Frank Gong, a strategist with JP Morgan in Hong Kong, said he would not be surprised to see some kind of announcement from the PBoC on currency over China's week-long May holidays, which start on Sunday.

"But the point is that they are ready to do it and could move at any time," he said. He said the higher rate remained on trading screens for up to 20 minutes, a sign that the authorities may have been testing the market "to see how much ammunition they may need to keep everything under control".

Hard for me to imagine someone not noticing the price trading outside a band thats been in place for 10 years.

* Update 11:20 AM - The FT has a second story that is more heavily weighted towards the trades being a technical glitch. It also mentions some statements in an official newspaper that "conditions for a renminbi revaluation were "ripe" thanks to reforms of the commercial banking sector and the forex market, although any widening of the existing band could be small."

FYI, Friday after the close is primetime for announcing currency band moves. The idea is that it gives the markets the weekend to figure out how to react.

* Update 1:45 PM - This story sums up a couple of banks' opinions about how and when the Chinese gov't will move the peg. I am surprised that a few are still not expecting a revaluation this year. Another story discusses this week's action in the won.

I am assuming that China will be successful in limiting any move to a small one (< 10%) but think that could still cause some pretty big trade adjustments around Asia. I expect the yen and won appreciation vs. Europe's currencies will continue.

Apr 28, 2005

Judging Fed Policy

The problem with an activist central bank is that decision makers in the real economy -- consumers and businesspeople alike -- mistake the Fed's point of view for strategic advice. And so do financial market participants.It is hard to be active in the markets during recent years and not be a bit bewildered about what participants are thinking. It often feels like the markets are only looking ahead a few weeks to a few months and are completely unconcerned about what current price levels mean over a longer horizon. I look at GM, FNM, or AIG and wonder how the prices at year end could have ignored all the negative news that came out during the fall. Throw in a housing boom and record low credit spreads and I generally feel Roach's frustration that the world is taking a much too optimistic view. He just goes a bit overboard in laying the blame on monetary policy and Fed commentary.

While Altig clearly wins the point by point debate he sets out I still have some sympathy for Roach's view that the Fed is basically trying to extract itself from past mistakes. Altig ends his piece with the following challenge for believers like me:

-- I gather the prescription favored by those who feel the same as Stephen Roach is for the Fed to be more aggressive in tightening policy. Fine, but is that what you really would have done in 1997, confronted with the circumstances at the time? In 1998? Would you have been impervious to the global financial stress I noted in the second post?I don't really have problem with Fed policy until around Nov 1998 and I think these issues are best addressed by Paul McCulley's more constructive Fed criticism from March of 2000:

-- Would you choose to ignore the fact that employment growth in the U.S. has consistently struggled to gain traction? Would you be confident enough that bubbles exist, and that monetary policy can do something about them if they do, to tighten monetary policy if you had some concerns about the underlying strength of the real economy?

Thus, it is just not credible for Mr. Greenspan to maintain that the wealth effect is not that closely linked to the stock market, when by his own analysis of a year ago, the New Economy stocks are running on a lottery principle. If his analysis of a year ago is still correct, and I certainly think it is, and if New Economy stocks have soared versus stagnant Old Economy stocks over the last year, which is a fact, then logic compels the conclusion that the excessive boost to aggregate demand that Mr. Greenspan abhors is related to the bubble in New Economy stocks.

Which brings us to the question of whether the interest rate tool is the right exclusive instrument for dealing with the problem. I know of no economic model that postulates a high interest elasticity of demand for lotteries! Virtually every economic model incorporates, however, a high interest elasticity of demand for the goods and services of the Old Economy.

Thus, using the interest rate tool exclusively to thwart wealth creation in New Economy stocks carries grave risks for the Old Economy. It makes no sense to try to get the attention of gluttons by starving anorexics. It's bad macroeconomic policy, and it is also morally wrong.

This is particularly the case in the face of evidence that the bubble in New Economy stocks is being increasingly fueled by margin debt, as vividly displayed in the graph below. While it is a free country, and everybody has a right to foolishly overpay for lottery tickets, I do not believe that the Fed should passively endorse the purchase of lottery tickets on credit!

Under Regulation T, the Fed has the authority to set initial margin requirements for the purchase of stocks on credit, which has been at 50% since 1974. The Fed should raise that minimum, and raise it now. Mr. Greenspan says "no," of course, because (1) he cannot find evidence of a relationship between changes in margin requirements and changes in the level of the stock market, and (2) because an increase in margin requirements would discriminate against small investors, whose only source of stock market credit is their margin account. I have rejoinders to both of those objections.I liked this passage because it draws a direct connection between Fed policy and the distortion between new and old economy assets that occurred in 1999-2000. With the collapse of the stock market the opportunity to correct that misalignment without a liquidity injection passed and the Fed has not had much choice since then but to keep rates accommodative in the face of weak employment.

Pointing out past policy mistakes might seem a bit useless but I think it is the backdrop that makes the current fiscal policies such a problem. Our economy has grown by leveraging making it more dependent on the stability provided by counter-cyclical monetary policy. While that has gone on the legislative and executive branches of government are doing their best to restrict future monetary policy by borrowing in a heavily pro-cyclical fashion (similar to Calculated Risk's conclusion).

None of this really explains willingness of the market to act as a co-conspirator preventing poor policy decisions from being reflected in asset markets. My personal guess is that executive compensation is just not very closely tied to long-term performance. That being the case anyone able to draw liquidity out of the system now can benefit from whatever future volatility may arrive. This is wandering off the subject a bit but it doesn't seem fair to ignore the obvious market flaws necessary for any monetary and fiscal mistakes to have a lasting impact.

While defending Roach's piece is a bit difficult, I am not that comfortable absolving the Fed either.

Market Malaise

Investment banks financing the purchase of US data storage group SunGard, the largest leveraged buy-out since the 1980s, are struggling to find buyers for the debt, raising fears that the downturn in high-yield markets threatens a new class of large private equity deals.This story sums up the market over the last couple months. I flagged a similar story a month and a half ago (a few days before GM lowered its guidance and really got the ball rolling). This theme of credit widening is my best guess about why the stock market just can't get out of its own way lately.Deutsche Bank, JPMorgan and Citigroup recently began syndicating a $4bn (GBP2.09bn) bank loan, part of the financing of the $11.3bn deal, to hedge funds and other preferred investors before moving on to a formal roadshow.

But early indications of interest in the bank loan and a $3bn bridge loan that will also soon be marketed, have been lukewarm, according to people familiar with the matter. “The SunGard deal is signed, but the financing is not done by any means. Fingers crossed,” said one.

In the spring of 2003 there was no announcement that low rates and easy borrowing would lead to a 2 year ramp job for credit and equity markets. The same thing is going on now in the other direction. It will only take one good deal to create a bounce in this environment but the flattening yield curve and weak expectations for U.S. treasuries probably contributed a fair bit to getting us here. I don't see those factors changing any time soon.

Apr 27, 2005

Good for a Laugh

It's hard to imagine a giveaway more over the top than the one Moonves and Freston receive at Viacom. Moonves, who lives in Los Angeles, owns a home in New York. When he stays at that home while traveling on business, he's reimbursed -- to the tune of $105,000 in 2004. Likewise, Freston -- who lives in New York and owns a home in Los Angeles -- was reimbursed $43,100 for staying at his L.A. domicile last year. Both executives earned about $20 million apiece in 2004. The company declined to comment.There is more but I agree with the author that this is the prize winner.

Today's Trading

Apr 26, 2005

Gold vs. Gold Miners

Posted by Hello

A few interpretations I can think of are: Gold stocks are leading the price of gold down just like they led them on the way up. The gold ETF (GLD) has taken the bid away for mining stocks as a proxy. And, mining stock prices relative to gold are being skewed by the recent negative preformance in equity indices.

I lean towards the last option with the second as my next guess. Anyway this can be played by rotating out of the metal and into stocks, rotating shorts to the metal rather than the stocks, or by creating a dollar weighted pairs trade. I am mixing the pairs trade with outright equity longs for myself.

Nigerian Woes

I mentioned Nigeria's belligerence a while back. Just think of the whimpering you would hear if oil wasn't trading at $50 /brl. Nigeria has always been a basket case and traded independently of other emerging market spreads so I am not sure their decisions can have too much of a knock on effect.

New Home Sales - Signs of Inventory Problems?

Purchases rose 12.2 percent to a 1.431 million annual rate in March following a 1.275 million pace in February, the Commerce Department said today in Washington. Economists forecast a 1.19 million sales rate in March, according to the median estimate in a Bloomberg News survey.I saw that headline print and my first thought was about the high recent inventories and how the headline might not be that great if producers had blinked and lowered prices. The numbers give some support to that idea. Not a disaster but certainly something to watch when every headline is pointing out a record high.

....

Residential investment contributed 0.19 percentage point to the 3.8 percent rise in gross domestic product in the fourth quarter. While that was more than the prior three months, it was less than the 0.86 percentage point in the second quarter.

Sales rose in three of four regions. They increased 21.9 percent in the Midwest to 217,000 at an annual pace; 13.8 percent in the South to a record 733,000; and 9.9 percent in the West to 399,000. They fell 8.9 percent in the Northeast to 82,000.

The median price fell to $212,300 in March from $234,100 a month earlier. Compared with the same month last year, the median price is up 1.3 percent.

The number of new homes for sale fell to 433,000 from 437,000 in February. The median number of months those homes have been for sale fell to 3.6 months in March, the lowest since August 2003, from 4.3.

[emphasis added]

I am getting pretty bearish on housing over the next 6 months. Like the rest of the market it probably pays to be patient after the recent weakness. I would not expect the housing stocks to reach for new hghs like new home sales did.

*update 12 PM - I have looked through the past median price data and am less convinced the price drop means anything. I have a natural contrarian reaction when I read the word "record" relating to monthly % changes though. The better interpretation is probably that if the U.S. consumer is hitting some sort of wall it has not showed up in housing data yet.

Apr 25, 2005

AIG Again

A bigger restatement is likely at American International Group after an internal investigation by lawyers uncovered additional problems in the insurer's accounting.I still have my equity positions from Thursday morning. The stop was broken and quickly recovered late Friday so I treated it as a washout and just reset the stop. I expect to get stopped out at the open now.Last month, AIG said it expected that inaccurate financial reporting could reduce its book value by up to $1.7bn (GBP 887m). However, the scope of accounting problems outlined in a report by Simpson Thacher and Paul Weiss, indicates that figure is low, according to people close to the investigation.

This news seems pretty bad for AIG but might not take the market down with it since the story is getting old. It is funny how the news cascades out of these large companies over time. Once the investigators are in, there are always more troubles to be found.

Apr 22, 2005

Staying Long

I mentioned the Swiss Franc yesterday and there is some impressive outperformance by the yen continuing today. I beat on the theme that European currencies could suffer if China revalues around the New Year. That may be what is going on now.

More thoughts on the currency moves and its effect later.

Apr 21, 2005

Risk Reversal?

Posted by Hello

Equities: Prices are Leading Sentiment

Probably just a short-term bottom (3-6 weeks) but certainly good enough reason to cover shorts and try the long side.

*update 10:06 AM - Buying above the open and raising stops to 50% retracement of the gap.

CPI and Chinese GDP are Lagging Indicators

Long story short the world changed last week and if that change is correct the CPI, record or not, is meaningless. It is a lagging indicator plain and simple.

Chinese GDP which also came in stronger than expect has the same problem. Demand in the commodity sector is a much better indicator of what future expectations are for Chinese growth.

Bond yields peaked yesterday around 8:45 AM and I am guessing it is the "lagging indicator" logic that caused it. The beige book came in weak but that was much later in the day, after the market had made up its mind.

On these data points I am not expecting any impact beyond what we saw immediately after the release. I disagree 100% with the view that these inflation number force the Fed's hand and need to be reflected by higher bond yields. Even if I did see the CPI (or Chinese GDP) as a reason to adjust growth expectations, I would prefer to go long copper or oil futures. For bonds to run into trouble here I think we need to see the dollar slip further.

I will try to put up several posts today to round out my views on where the economy is going and my interpretation of recent market moves.

Apr 13, 2005

More Jobs News

Good news is ahead for 2005 college graduates. This year's job market for entry-level workers demonstrates a markedly improved economy, with job opportunities available in a variety of sectors. As the leading careers site for college students and young alumni, MonsterTRAK today announced the results of its annual graduation survey of college students, recent graduates and the employers who will be hiring them. Among the findings, 80 percent of companies surveyed with 5,000 or more employees plan to hire 2005 graduates this Spring/Summer and a remarkable 90 percent of companies with 10,000 or more employees plan to hire 2005 graduates. MonsterTRAK is the student division of Monster(R), the leading global online careers property and flagship brand of Monster Worldwide, Inc. (NASDAQ: MNST).This follows my own post yesterday on career choices for college students and is an interesting aside to Brad DeLong's thoughts on why labor market slack has persisted for so long.

I am not really a big fan of Monster's numbers because they have been consistently stronger than other measures. This survey doesn't seem to have the usual problem of separating Monster's own growth out of the data though.

The Dollar Might be Getting into the Game

The world appears to be shifting into global slowdown mode but so far the dollar seems a bit out of step. The commodity gains late yesterday evaporated this AM but the dollar is beginning to drift towards its overnight lows which could change things a bit.

Slack Labor Market Indeed

The ILO reports that unemployment worldwide hit a record high last year of 185.9 million people worldwide, or 6.2 percent of the global labor force.The political class claims to have the answer, but unemployment is not the result of any one cause. It makes its appearance in a great variety of circumstances, some in personal factors, some in economic changes, and some in legislative and regulatory conditions. Throughout the year some workers may appear in the labor market and then withdraw. Students work during the summer and return to school in September. Building and construction activities, logging and lumbering, slaughtering and meat packing are very seasonal and give rise to a considerable amount of temporary unemployment.Similarly, industrial and technological changes may force workers to readjust and relocate. Jobs, wages, and working conditions always point the way.

I would have thought it was more of a U.S. and Europe problem which would be outweighed by the larger populations of Asia. I have never used this data stream before so I don't make to much of it other than to be surprised it is setting a record.

Apr 12, 2005

About this Reversal

Keep in mind with bonds the shorter maturities should put a pretty solid floor under longer-dated yields. The 2-yr is around 3.70%.

*update 3:30 PM - I should add that Phelps Dodge (PD) filled a gap this morning (from 2 weeks ago) and is now attempting to climb into the green as well.

Employment Anecdote

Teach for America is attracting a record number of applicants this year. The program recruits top college graduates to spend two years in low-income public schools as teachers. At Dartmouth College alone, 11 percent of the entire senior class at has applied.It still seems like the U.S. economy has pretty slack demand for new workers if this is the case.

Apr 11, 2005

Back in the Saddle

We have now passed the weeks away with the DXY bumping up into its 200 DMA. This week should be good for a turnaround. Gold and silver are strong this morning which confirms at least a short-term return to the old trends. I am wondering a bit we will get strong equities and strong bonds too in a return to the old paradigm. I would be surprised to see bonds play along in that but maybe it could happen for a week or two.

Not too much has been going on in the news. I liked this article from William J. Polley that shows the similarity of the current Fed Funds cycle to the cycle we went through in the early 90's. He is planning a series of posts on the topic and I am looking forward to what he has to say.

Apr 2, 2005

Are U.S. Savings Rates Really Too Low?

Bear Sterns chief economist David Malpass rubbishes the notion that the US does not save enough:

Not only are we not running out of household savings, it is growing fast both in terms of the annual additions and the cumulative buildup of American-owned savings. Household net worth, one good measure of savings, reached $48.5 trillion in 2004. Time deposits and savings accounts alone total a staggering $4.3 trillion, versus slow-growing credit-card debt of $800 billion. True, the U.S. is the world's biggest debtor, but it is building assets faster than debt. Even if household assets took a hard fall, the remaining net worth would still dwarf other countries'. On a per capita basis, counting mortgages but not houses, net financial assets total $89,800 in the U.S. versus $76,900 in No. 2 saver, Japan. Of course, some households don't have nearly this average, creating risks for them and burdens on others in the event of a downturn. This is an appropriate policy concern, but the macroeconomic issue is aggregate savings, of which the U.S. has an abundance.

According to the Federal Reserve's flow of funds data, the 2004 additions to household financial assets were a net $590 billion. This was 6.8% of personal disposable income, providing a meaningful measure of the cash flow going into new financial savings. This increased the household's financial net worth to $26.1 trillion, way above any other country's savings and plenty to fund profitable domestic investments. If the 2004 appreciation in the value of homes and equities were also counted, the 2004 saving rate was 46% of disposable income. Foreign savings invested in the U.S., the counterpart of the widely criticized current account deficit, is additive to our own large store of savings.

....

Meanwhile, foreigners are actually losing ownership share in the U.S. despite the $2.6 trillion net debtor position, since U.S. assets are growing faster than foreign savings in the U.S.

A couple of gut reactions that I have are, man if homes and equities give back 2004's gains that is going to be one interesting experiment in wealth's effect on consumption. And,"losing ownership share" sounds an awful lot like selling.

Brad Setser commented on U.S. borrowing and foreign investor disinterest in U.S. equities a while back.

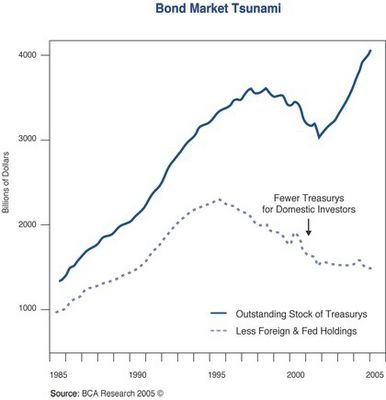

In broad terms, roughly $890 billion in net external debt issuance by the US financed the $666 billion current account deficit, $170 billion in equity outflows, and $57 billion in net outflows from banks and non-bank financial firms.Bill Gross provided the chart below in his Investment Outlook near the end of February.

Posted by Hello

It shows the shrinking share of U.S. treasury stock owned by U.S. private investors. Rightly or wrongly U.S. investors are focusing on carry trades to generate wealth. Malpass sees this as a good idea while I have my reservations.

Malpass has a valid point that perhaps the imbalances of the world represent an excess of savings relative to investment opportunities. U.S. interest rates have been set by the Fed and reinforced by the purchase of foreign central banks. Neither of these represents a market process so my concern is eventually markets will set base rates higher and turn carry trades into losers. The world economies dependence on U.S. consumption just heightens the risks if U.S. investors have taken on too much risk at the wrong time.

Apr 1, 2005

Weakness Again

With the poor jobs showing again this morning I really see two scenarios for inflation and rates: One, weak growth reverses inflation trends and interest rates stop rising. And two, cost push inflation leads to higher interest rates slowing growth. I am leaning towards the second. In the first housing and commodities go down together but in the second my trade should make money on both sides.

Non-Farm Payroll Summary

Around 4.0 - 4.1 the five year yields are retesting last years highs.

Ready for the Jobs Report

I first heard calls for $85 oil back in December, then again at the beginning of March. Then we had an OPEC meeting that basically indicated spot prices are now driven by estimated demand in Q4 and thereafter. With spot prices unhinged from the present details that market is ripe for speculators to push the price wherever they want. In judging the moves it is probably best to keep an eye on the far forward contracts rather than the front month.

Adding to the inflationary comeback yesterday, Merrill Lynch increased its price forecasts for copper, aluminum, nickel and zinc for the next three years. The industrial metals did not respond too dramatically but stocks like Phelps Dodge (PD) are now back wrestling with their breakdown point from Tuesday.

The dollar was steady to down and bonds rose on all this information. I don't think the jobs report will add to inflation pressures but instead will continue to be lackluster. This provides fuel for people like Roach who question whether the Fed will really fight inflation in the face of weak growth. That is a recipe for steepening.

Stocks look like they could stay strong no matter what the number but it kind of feels like the dollar wants to come back down a bit. We shall see.