This is a trading diary containing my views on international financial markets and economic news. I focus on the relationships between bond, currency, commodity and equity markets across countries. All ideas and opinions expressed here are shared for educational purposes. THESE ARE NOT RECOMMENDATIONS!

Nov 30, 2004

Topping or Basing?

The third is the news flow itself. The news for stocks has really knocked a lot of legs out from under my bullish arguments from a few weeks ago. There was news that Freddy Mac has been increasing activity to fill the gap left by Fannie's forced conservatism. Japan's GDP growth was revised down showing that not only can they not lead a recovery, they can not even keep up with the world. The congress that everyone thought would ram through tax reform, social security reform, and tax cuts is currently split and holding up a widely popular intelligence reform package. Wal-Mart's miss is the icing on the cake. It comes on the heels of a weak durable goods number overlooked during the holiday festivities. As everyone knows the consumer is the heart of the economy and such a poor showing while loan rates are still low just makes higher rates seem all the more dangerous. And of course Fed officials have continued talking up rates past market expectations. I see many hopes that have been proven false here but other than the charts themselves I have a hard time finding reasons to buy stocks.

Nov 29, 2004

Strange Days

In case you missed it there was a run on the banks in the Ukraine as the result of their election turmoil. When really bad things are happening people tend to lump events together so the phrase "run on the banks" outside of historical reference should never go unnoticed. Are those Ohio vote counts done yet?

More Retail

The World's Biggest retailer

Click on the chart to see a larger image!

WMT (Wal-Mart) is already out saying that sales were not so hot on Friday. They are also lowering their ytd growth to 0.7% from the 2-4% range they guided to 10 days ago. I have been watching WMT pretty close as it pulled back to support. It will be interesting to see how it trades tomorrow. My best guess is down to 54 in the first hour of trading and then a bounce. Where the bounce goes will say a lot about this market. WMT's problems were the result of competition so it will also be interesting to see if the market rewards or punishes the other retailers.

I expect the market to be down as a whole tomorrow but whatever happens I think tomorrow will set the tone for the week. Maybe I am being too simple but I think a strong Monday will mean a strong week and a weak Monday will lead to weakness. The market has to make up its mind whether momentum has taken hold or if we need to retest some breakout levels.

Nov 28, 2004

Inflation, the Yield Curve, and the Dollar

From Between the Hedges on November 20.

Originally posted with a chart of CPI and PPI.

Bottom Line: While some measures of inflation have spiked recently, due mainly to the effects of the hurricanes, they are not even to levels seen in 2000. As well, it is highly unlikely the CRB index, the broadest measure of commodity prices, will continue to rise near recent rates. The rise in commodity prices has been the main source of inflation thus far. Unit labor costs, which account for more than 70% of inflation, have remained well-contained.

My Comment to Between the Hedges

Difficult to understand the comparison you make between inflation in 2000 and now. The front end of the U.S. interest rate curve was never below 5.50% in 2000 and now we are at 2%.

Inflation is not a problem but without much higher rates I am not sure why it would peak here like it did in 2000.

michael 11.23.04

I am not comparing. I am just stating a fact. Inflation was more of a "problem" then, yet we didn't harp on it incessantly. Modest inflation has historically been good for stocks and that is what we have now. Low interest rates now are telling me disinflation is more of a problem than inflation. The CRB is likely to decline over the next 12 months. Commodity price increases have been the main source of inflation worries.

Gary 11.23.04

My follow up thoughts.

I disagree entirely with the idea that people here are worried about inflation. Central banks around the world have learned to tame inflation and there was a risk of deflation last year so I think most people view 2% inflation as a relief. What people are worried about is higher interest rates. That is the only mechanism central banks can use to control inflation. The U.S. economy is more highly levered than at any other point in history and if interest rates move up significantly, from these "accommodative" levels, then it is difficult to see consumer spending and corporate investment being maintained at current levels.

Expecting the trend in inflation to change of its own accord is silly and I trust the Fed's ability and desire to control it. The only issue is where interest rates will be a year from now and if our economy (and the world economy) are prepared for that level of rates.

Gary also raise the point that the yield curve is flattening indicating disinflation. Personally I see the flattening as an anticipation of immediate dollar weakness. During currency events bonds will trade on a price rather than yield basis as the loss to principal overwhelms the gains from interest payments. The currency adjustment punishes all principal equally but a 30 year bond gets to discount the loss over 30 years. A flat curve indicates the currency adjustment is going to come all at once and chop an equal amount off principal at all maturities rather than a steady erosion that inflicts a larger loss on principal payments further in the future.

Page 9 of this paper has a good chart showing the spread inversion of the Brazil IDU bond (2001 maturity) against the spread of the C bond (2014 maturity) back in 1998 (after Russia devalued and the market began to anticipate a Brazilian dollar default and real devaluation). There was also a nice article on Friday which came to a similar conclusion about the message coming from interest rate markets.

Nov 27, 2004

A New World Order

Click on the chart to see a larger image!

This chart of U.S. 5-yr yields against the dollar index shows a definite change of character since the U.S. election. Except for a brief separation in March yields and the dollar moved up and down together. Now they are flying apart. The relationship could revert in the short term but it does not really seem very hopeful. So far the dollar has performed much worse than bonds but I would expect that bonds will catch up (fall that is) in the weeks ahead.

In my first entry on Oct 16 I wrote, "Obviously I am looking ahead here and am still very open to changing my mind (say if the yen trades below 103/$ in the next month) but to me the global imbalances are showing signs of correcting in an orderly fashion." When I mentioned "changing my mind" I was referring to my generally bullish stance on the stock market and economy. The yen traded below 103 on Nov 18. The equity markets still seem alright and the sideways range of last week lends strength to the idea that we are entering a momentum market on the upside but the dollar and yield movements are giving me the willies.

Though the market momentum may last a bit longer I am getting the feeling this will end badly. Higher prices in the face of bad news can be a sign of strength but they can also be shorting opportunities. I entered some shorts in December equity puts the week before last and have been accumulating Dec and Jan UST puts over the last month. While my views are shifting here, rather than change them wholesale I will stick to my original strategy with each trade. The equity puts are all short term and whether we rally or fall I will be out of them next week. The bond positions are fundamental and longer term but I am hopeful that I will get to book some profits there shortly and roll out the trade maturity.

I will begin looking for some positions in long dated out of the money puts now and may enter into them over the next month. Nothing big just something to put my mind at ease and that I can add to over time and if my conviction increases. I don't have much conviction in my short term views here (probably the poorest feel since I began this blog a month ago) so I am focusing a bit more on longer term trades. I would still like to accumulate some cyclical stocks on a pullback and some precious metal stocks seem to have underperformed the dollar move.

BBC Firefox story

Nov 24, 2004

Put GE on the list

I would put the resilience in the face of a weak dollar in the plus column but that is not going to help much into the close.

Took a stop

Bad trade

Action is positive but a bit hesitant in the market over all. Lots of people looking at the positive calendar bias around Thanksgiving. WMT (Walmart) is breaking down a bit after a strong open. The retail stocks are probably on pins and needles with the holiday season upon us so that name demands some attention.

Firefox!!

I downloaded it myself last week and am generally impressed. I really like the FoxyTunes extension, tabbed windows and general clean feel of it. I guess Firefox is mainly popular with developers and bloggers now but I would say being popular with that group could lead to bigger things.

I have not heard anyone in the markets mention this product. Lots of focus on Google's desktop search and whether Google was going to launch a browser but Firefox has apparently slid under the radar. Given the short time it takes to download a new browser, this could potentially create quite a surprise.

Wandering around

One thing that stands out a bit is the failing in the SMH (semiconductor holders ETF) and I would point to KLAC (KLA-Tencor) as the main culprit there. INTC (Intel) broke down today and AMAT (Applied Materials) had some earnings problems last week but neither of them seems to show the same problems as KLAC. AMAT even seems to be putting in a very strong pattern in the face of some pretty bad news. Maybe a pairs trade make sense for those two.

Nov 23, 2004

Dollar Drip

I would add that the holiday week will make any damage that much worse. This is an American holiday and foreign traders will not care that U.S. markets are not open to react.

Dollar bounce

If the dollar and the stock market continue their link this will weigh on stock tomorrow. Of course the dollar has to keep its gains. We shall see.

Slap shot

Click on the chart to see a larger image!

Not much stood out in the action today but this driller looks like it is about to join its brethren on the march.

Whether or not today was really a stop hunt was hard to say in the end. The action certainly felt like it was being managed on the way up but in the end they closed them well and the action also felt like shorts being squeezed. I find it hard to believe the upside is the more painful direction for the market to trade now but perhaps I am wrong.

The bond market got a good bounce today reversing some of Friday's losses and that is a solid reason for a rally in equities. Higher rates are on the way for all yields it seems but I guess until they arrive the market does not need to react.

Nov 22, 2004

Stop hunt

NEOL which I mentioned in a post last week is getting a crazy pop on a brokerage upgrade today. Usually worth it to book some profits on a move like this. Keep something for the long run but at least guarantee a positive trade.

Nov 21, 2004

Charts for shorting

Click on the chart to see a larger image!

HSY (Hershey) looks like an excellent short with a very clean double top. I selected it for purely technical reasons and then smacked my forehead a bit as I recalled what has been going on in the Ivory Coast for a couple of weeks. A good target for this move down might be the 50 day. I almost included a chart of SBUX (Starbucks) here, also for technical reasons, and checked the news a bit on that one too. While coffee is important to the Ivory Coast it is still only 3% of the world market. Doesn't mean it can't work for a trade but the news gives better support to a HSY short. Both companies' bottom lines are driven by many factors besides input prices but often that does not matter to the market in the short-run. Relevant or not markets are drawn to stories.

LM (Legg Mason) made a big contribution to the breakout in the broker complex but since the initial move it appears to be running on fumes. Because yesterday's selloff also lacked volume, shorting here is a bit dicey and I would wait for an inside day (between yesterday's high and low) to initiate a position.

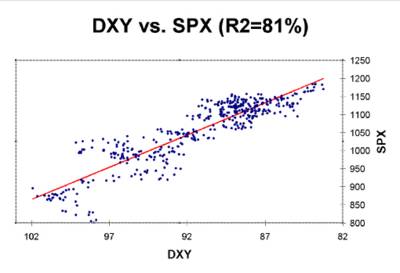

S&P 500 relationship to the dollar

Click on the chart to see a larger image!

This is the relationship between the stock market and the dollar that I mentioned on Friday. While I see the logic that a falling dollar helps exports and profits at multinationals I am not convinced these factors can offset the interest rate effects. During the late 90's the strong dollar was good for the markets because it was evidence of foreign investment. This made sense because the strong dollar and low interest went together and led to an investment boom.

The dollar is still the world's reserve currency so maybe U.S. interest rates can stay low indefinitely but my guess is that in the very near future U.S. interest rates will head higher. Whether it is because the falling dollar causes inflation or capital flight, I can not say but both pose very real risks. The optimism being exhibited by corporate bond buyers here makes me question whether the capital markets are really prepared for the change.

Nov 20, 2004

The Money Illusion

Click on the chart to see a larger image!

A skunk at the party? A dead canary in the coal mine? You bet! If I had to make a list of individual companies that could collapse the confidence-based, global financial system, this bank would be near the top. As I here the story, JPM is the single largest derivatives counterparty in the world (no one but JPM knows this for sure). FNM hedging, hedge fund levering, mortgage lending, emerging markets lending, swaps, currency hedges,... Etc., they do it all. The fact that it is showing such a horrible pattern in what is a great market should make headlines shortly. It could be benign evidence of traders shying away from a stock with a lot of bad exposures and little to gain from a commodity driven rally in a rising interest rate environment but it could also be a sign that something very rotten is happening with a particular trade or counterparty. Maybe it is just FNM but so far JPM trades much weaker than that stock does. Whatever the reason this stock absolutely needs to be watched here.

This is a good step-off point to distill what I see as the core bullish and bearish arguments in the market. Bulls believe that counter-cyclical interest rate policy has worked. It has created some near-term distortions in borrowing and asset prices but in due time these problems will work themselves out as global growth comes in above expectations and perpetuates a virtuous cycle. Bears, however, believe that central banks can not possibly do better than the market at setting interest rates and that any such counter-cyclical policy is creating greater pressure somewhere in the system. Ultimately that pressure will blow up a major money center bank causing the faith that supports our capital markets to disappear. When it does all asset prices will tumble as there is not enough liquidity to support current prices.

While I see both sides of the argument and truly see both of them as correct in the big picture, I absolutely lean towards the bulls case here. This is based solely on my own view of the prevailing psychology. More and more bearish investors that I know and talk to are focusing less and less on individual problems and situations and are obsessed with the idea that the euphoria of 2000 has not met its mirror image yet. True or not it just makes for bad trading and a weak hand. Money is made trade by trade and hanging on to a vague idea that the market needs to head a particular direction is a recipe for losses. Yes, the trading does feel more and more like 99 but it also feels a lot like 95 and 96. To be looking for a disaster here you have to expect the market to be blindsided by a liquidity crunch and so far there is just no evidence that it will ever arrive (see definition for blindsided). I don't think we are in a position to launch the next great bull market but I definitely think we could see renewed involvement from retail investors which can create a very profitable trading market.

If the JPM chart turns out to be a lead indicator of a deeper problem, I will need to reevaluate my stand. That is why I posted it.

Nov 19, 2004

crow

Precedent

These famous remarks led to a 3.2% drop in the Nikkei, a 4% fall in the DAX, and a 2.3% drop in the Dow. All of which were reversed within' a week. I am not really sure Greenspan is telling markets anything more revolutionary in his remarks today. The markets certainly were due to pullback and it is important here to realize that even with the dollar weakness we are not really entering uncharted waters.

As I write yields look like they are going to put in another leg higher, and at the risk of embarassment I still believe this yield move is going to drive a currency reversal.

Greenspan

I don't think many people were looking for a conflict between monetary policy and fiscal policy where the Fed attempts to reign in the debt but that seems where we are heading. This should shake things up in all markets but mostly thru interest rates. Corporate bonds seem particularly vulnerable in here with historically tight spreads and historically low yields.

Morning reversals

Dollar positions

- It is extremely oversold.

- The DXY came very close to a key reversal day yesterday. It traded a lower low and reversed to a higher high but closed inside Wednesday's range.

- The APEC meetings will provide an opportunity for everyone and their mom to weigh in on how horrible the dollar sell off has been for their country.

- The March low in the the JPY is 103.42

- Other trends of the last couple weeks appear to be hitting a turning point. The OSX put in a strong day Thusday while momentum seems to be failing in the SPX.

Nov 18, 2004

More recession thoughts

Tonight's FT has Richard Davidson of MSAM echoing the PIMCO comments last night. He is looking at a 50% chance of a recession in '05 predicated on the recent oil spike and reduced tax stimulus.

"Davidson is particularly enthusiastic about Europe, where dividends are growing at a double digit rate and where cash deals now top 80 per cent of all mergers and acquisitions activity, normally a bullish sign. He is also keen in Japan, where he believes good progress has been made on banking reform, corporate balance sheets have been restructured, manufacturing capacity has been reduced and the return on equity is rising.

Within the bond market, Davidson is underweight US Treasuries, saying yields are too low in the light of rising producer prices and the falling dollar. He has a holding in gold (which reached its highest level since 1988 on Thursday) as a hedge against the US currency. He also owns no corporate debt, arguing that spreads are too low to reflect risk."

He also expects U.S. rates to continue rising while U.K. rates have topped. As for his Japanese comments, today's downward revision in GDP estimates there may provide a buying opportunity. It is not clear if that news was out during the interview but typically GDP data is backward looking and is not a good reason to change an outlook.

Morning Glory

Israel can not be pleased about the thought of Iran with Nuclear missles.

Gross' firm is weighing in on the current state of the bond market.

Heard stories that an Asian central bank bought $12 bn in US treasuries yesterday.

Add that to the $2 bn the FT said Korea bought last week. Whoever is buying, I can not see

why they are investing anywhere but the short-end. If it is Korea or Japan the duration risk just gives them more to lose if their currency intervention fails.

Nov 17, 2004

Momentum market??

Perhaps the hour is upon us for some opportunistic shorts (financials) and to roll up trailing stops to keep profits from slipping away. Tuesday marked a short-term trend change in my book and I will be suspending buying for a while to hunt shorts and defend profits.

Understanding inflation

That may be just what the Fed is looking at as it tries to talk up interest rate expectations.

Nov 16, 2004

Swing trader's market?

Now with FNM finally getting addressed, jobs trickling in, marginally improved exports, most rate hikes behind us, and strong momentum off the election doesn't the bull case seem equally compelling? Maybe not equally compelling but certainly a good bet.

If the tape did not respond to price breakdowns while the environment was ripe, I am just not sure you need to chase it here. I see no compelling reason to buy until SPX 1140 and even then I would trade a half position looking for a shakeout lower. There will certainly be sectors and stocks that can run for the next 6 months but there will be time to be selective. Too many people here are trying to turn a one day move into a multimonth trend and I just don't think the market is going to be cooperative.

Beware the flattening

Yesterday Fed Gov. Olson Spoke and the most striking part of his speech to me was the comments he made on real interest rates. After noting that the overnight rate remains accommodative he went on to say, "The nominal federal funds rate is currently 2 percent, a level that, using standard measures of core consumer price inflation, implies a real funds rate that is just above zero--considerably lower than the long-run average of about 2-3/4 percent." Nobody is expecting a Fed Funds rate of 3.75% anytime soon, not the Fed and certainly not the markets but that is the rate his comment implies. I was surprised his remarks did not have more of an impact on bonds yesterday and we may end up with a when-are-they-going-to-stop-hiking-panic in the short-end eventually. Not even close yet but the short-end is definitely reacting.

Even without a panic I think the treasury market will at some point steepen back out as people begin to find a 4% 5-yr rate attractive. Could take a while to play out as the market's belief in a low overnight rate is based in the belief in a weak economy. These Fed comments should be telling markets that they don't perceive the same need for stimulation.

This last point is also the only way to reconcile the strength in stocks with a curve flattening. Flattening is a sign of slowing growth and by keeping the long end low the bond market is not showing the same respect for the economy's strength (or even fear of inflation / stagflation) that the equity market is. In March of '03 the bond market was proven wrong and I think they will be here as well. I have absolutely no doubt that the Fed will avoid deflation and I have a growing faith in the U.S.' ability to export its way back to balance.

Until the Fed starts to give signals that rates are no longer accommodative I think it makes sense to be short bonds. The flattening is making me see the long end as vulnerable to a sharp move higher (yields) like the moves in the Spring of both '03 and '04.

position in TLT options.

Train thoughts

Today with the Fannie Mae's (FNM) failure to file and the broader news interest in the vote recounts we may see just such a shakeout. It is hard to see the election outcome being overturned and I don't believe we will learn it was rigged but if you were a buyer on clarity, it will get harder and harder to justify ownership as the tape heads lower. FNM is a similar story. The bad news has been out for a while in my opinion and the only thing keeping that stock up is that it has been dead money on the short side. If it starts to work lower and breaks below 62 it could trade with a 20 handle in a hurry.

If you want to read up on the vote recount I recommend this as a summary, and this to get an idea for how old the news is.

It is still way before the open and the downdraft may not materialize but I am thinking we get a brief scare today, sideways trading into expiry on Friday, and then we shall see if the pullback will be deep as I expect. Plenty of time to square up long positions or if you like to spin positions every couple of days you can even get short.

Sterling! Cable! Pound!

The dollar is finally getting a feeble bounce but I continue to believe shorting GBP/JPY is a better trade for the long run. I think it will break the support around 194 shortly and test the Mar lows after that. The world's growth is going to be centered in Asia and British interest rates are peaking. These factors could make this trade even more attractive than USD shorts.

What's on your plate?

The chart of Intstinet demonstrates the renewed belief in retail trading. The pattern is also reflected in TRAD (Tradestation). They are good charts but I think it is a Texas hedge for people who make their living in the financial industry already.

This chart also looks like it has lots of upside.

Nov 15, 2004

Perspiration

The dollar is advancing a bit today but the DXY is still well below 85. Metal stocks are showing some weakness on the currency moves. Most notable to me is NEM which is failing right near its old high posted in January. I would expect it to breakout the next time.

All in all I still don't trust the averages here but the rotation evident in today's tape is a good sign for a longer term bullish outlook. The world seems divided into two views here. Those that are hoping for a pullback to buy and those that are just buying here. I am buying here but very little and keeping plenty of dry powder for a pullback.

My kind of Chart

All charts posted with Hello!

These two charts are both the kind of patterns I am looking for in this market. The market as a whole is overbought and needs a breather. That breather may turn into a pullback that reaches the 200 day and shakes out some longs that got in late. To avoid being one of those longs I am focusing on stocks with nice patterns that have not rallied with the market but are beginning to show signs of interest. There are a lot of stocks like these out there and I plan to just keep scanning and scaling into a couple of positions a day.

Nov 14, 2004

Ostrich

Watching the markets here the rally that began in August looks like the participation phase of a longer term move that began in Mar '03. I don't think the August move took many traders by surprise and the retail participation is a force to be reckoned with. I also continue to think that strong IPO's by publicly recognized brand names will continue adding fuel to the retail psychology.

A big wild card here is U.S. interest rates. I am surprised the Fed did not signal an end to its hiking cycle. They could have done it simply saying they were going to let their past hikes work or by claiming inflation risks have ebbed. I believe that the Fed usually has better information than the markets and that their comments lead the news by about a month. We are at a delicate point here where oil rates are near there highs and have now worked off an overbought condition. Higher oil is just the tip of the iceberg as we are also approaching a point where it will become clear whether commodity price increases can be isolated or will lead to cost push inflation. The pop in bonds at the end of the week may continue for a couple of days but ultimately will be a good point to get short.

Nov 12, 2004

Oil Enema?

We had some more proof from AMG this morning that retail investors like this equity market. Good if you are a broker but probably less good if you own stocks. Retail investors generally have horrific timing. As I said yesterday, it certainly explains the momentum in the tape.

Morning thoughts

Their was a surprise Korean rate cut yesterday, and people are taking it (in conjunction with comments out of Europe and Japan) as an indication that a round of competitive currency devaluation is underway. If this were the case you want to own commodities and basically try to short the next country that will cut rates. I am not sure I agree with this. The U.S. definitely does not seem in the mood to compete on currency so if other countries are the dollar should be rallying. Politicians can not help but comment on rapid currency moves or new highs (the Euro) but it rarely translates into action. A lot of people are long commodities and have been preaching this competitive devaluation (printing money) stuff for years and I tend to see their thoughts as wishful thinking. The Fed's comments on Wednesday and over the last year have indicated that they don't see a lower dollar as necessary to growth and generally are skeptical of any meaningful economic benefit to managing the currency.

This morning CNBC mentioned that people are now looking to positive benefits because of tax reform in the U.S. as cause for an equity rally. With any such policy change the devil will be in details and there will almost certainly be some losers as well as winners. If it improves transparency and efficiency it would be bullish but why is the dollar ignoring the possibility? I am all for tax reform and anything else that saves me time and effort but history has proven that though it should be a simple thing, nothing in politics ever is.

GM acknowledges reality

GM said in a regulatory filing on Thursday that it would probably reduce the discount rate it uses to calculate healthcare costs to 6 per cent in 2005 from its current level of 6.25 per cent." - FT

Nov 11, 2004

Grindin' em out

I will chime in here with my two cents on Social Security privatization. I am not sure the net flows will be so large for the markets. The plan will be offered as an option and currently nothing prevents savers from buying equities privately. Technically they could even own equities on leverage via the futures against their expected future social security income. I don't think anyone does this but it is an option for anyone that preferred equity risk to U.S. Gov't risk. The larger impact to me seems on the budget side as this program will make it more difficult for the Gov't to lump social security in general revenues. That is probably good long-term but could be extremely painful in the short run.

I would close with an interesting data point that came to light yesterday from Hewitt Associates. "On November 3, the Hewitt 401(k) Index logged the largest daily movement of money into equity funds since January of this year, with 0.13% of 401(k) balances transferring on a net basis. " This statement surprised me in a couple of ways. I am amazed that the average 401k investor was patiently waiting for the election to be done before moving funds and I am amazed they took rapid and decisive action the day after the election. Couldn't they have just shifted the allocation of future contributions to reflect their bullishness rather than the quick one day shift? Would have made more sense if the jobs number had come out the Friday before the election so they could be sure the economy was not falling apart. Not quite sure what to make of it since it is past but I thought it was an interesting statistic. No doubt that caused a large portion of our move higher and does a lot to explain how the tape remains so extended.

...and options

I expect next week to see continuing pressure on the VIX. Over the long run should head lower as too many people are sitting on trading desk trying to game the next point and through next week I bet lots of options holders are going to tire of waiting and lock in some profits after the big move we just had. This trend can go on for a long while as very few people seem aware of the structural impact of hedge fund dominance in daily trading. People see the leverage in the economy implying higher risk and thus higher volitility but that argument has been very wrong and I think it is because we are no where near the limits of liquidity available for short-term trading.

More on the dollar

I found this just to give an idea of the size of decline people are looking for in the dollar to alter the balance of trade in a meaningful way.

Morning thoughts

Don't have a very strong feeling of what will happen today. I would guess bonds continue to weaken. Many people believed the Fed would keep rates low indefinitely and some are taking yesterday's comment that rates are still accommodative to mean rates are going to be taken back near historical norms (3% instead of 2%). Time will tell. The comments definitely indicate a December hike but beyond that I don't think they give much indication. At any rate a 4% 10 yr will seem very expensive if the overnight rate heads to 3%.

I will probably not be doing a whole lot but I generally think the U.S. equity market is going to remain stable over the next 9 months so accumulating stocks with good technical patterns makes sense. Very little seems to make sense on the short side right now but maybe that will change over the next week.

Nov 10, 2004

Gross on CNBC

Fed Impact

I would call it bullish for the long end of the treasury curve too as the Fed seems to be taking proper precautions against inflation.

All in all the report was what the market was expecting so the net effect should simply lend more confidence to the markets.

Fed Day! Fed Day!

Most forecasters believe the Fed will update its language to indicate that

in the wake of the very strong October jobs data, the employment sector has

improved. At the September policy meeting, the Fed said "labor market conditions

have improved modestly," and observers believe that now, that final word will be

chopped. Meanwhile, while the Fed said in September that "output growth appears

to have regained some traction," analysts also believe things have improved

enough to speak of that growth in more enduring terms.

In August, the FOMC blamed the unexpected slowing in growth on rising

energy prices. Fed officials said repeatedly that they expected the rise in

energy to be transitory, and while their timetable was a bit off, oil prices

have been moderating of late. In September, the Fed again noted a "rise" in

energy prices, which Matus now believes will be reidentified as a "past surge."

Where there's a bit less clarity, it's on how the Fed will approach its

inflation views. Few forecasters think the central bank's so-called balance of

risks statement will be changed. But there's fairly broad-based support for a

move that would see the Fed note some modest level of concern about price

pressures, especially in the wake of the consumer price index for September,

which showed an unexpectedly strong gain.

Perhaps the part of the Fed's policy statement that gets the most attention

is the third paragraph of what's become a very ritualized document. In that

section the Fed's balance of risks between growth and inflation is found. But

more importantly, it's the spot where policy makers have been signaling their

outlook for monetary policy. Since May, the Fed has been saying that "policy

accommodation can be removed at a pace that is likely to be measured," even as

they've made that statement contingent on the course of economic data.

Markets have long interpreted that phrase to mean the FOMC would lift interest

rates at each of its policy meetings for an extended period, a view Fed

officials have clearly been comfortable with. But until the release of the jobs

numbers last Friday, there's been a growing view that the FOMC might skip the

December rate hike- some Fed officials themselves indicated a pause in the rate

hike campaign might be in the offing. But the employment data washed away many

of those expectations, and a large number of major investment banks now expect

the Fed to also lift rates in December, so look for a repeat of the "measured

pace" language.

I tend to think the statements lean towards contentment with growth resuming and inflation remaining low. I would guess no acknowledgement of changing energy prices and the word measured may be dropped.

The market is now positioned for a December rate hike and to me the risk is that the statement by not confirming this view will lead to a reduction of the market probability. We shall see at 1:15.

Bang the Drum slowly

Nov 9, 2004

home builder

I would also point out that the Iowa futures market had an 89% chance of a December rate hike priced in this AM. I agree that the jobs number was good but I am just not sure it was that good. It is a bit convoluted here as the stock market seems to see the economy as strong enough to handle the higher rates. I had been viewing the end of the rate hike cycle as a bullish event and I need to do some thinking about what it would mean given current expectations.

Stocks are really the wildcard as all the options seem like they should move yields higher.

Charts for thought

Really not too much stood out in today's action. I flagged these three charts because they all show the beginnings of a breakout from a reasonably long base. More importantly is that all three of them are Chinese stocks. One is a manufacturing stock but the other two are telecoms. I generally like playing strength or weakness across whole sectors and while 3 stocks is really the bare minimum to indicate something is afoot I thought I would point it out. The patterns are all close to support giving a generally low risk entry.

Nov 8, 2004

Whole lot of sitting...

I suppose you could say that today could have been worse given that the SEC investigation of brokerages is a ready made excuse to take profits but I think last weeks rally generated a fair bit of momentum that will take days to bleed off.

Not much to take away from all this except that patience is a virtue.

Nov 7, 2004

Chart Catch up

The story of the week is the breakout in all the major U.S. equity indices. While I do think that over time the economic numbers will justify the equity advance, I would expect the uptrend to look a lot like the downtrend we just went through. The SPX made new lows three times this year and each proved to be a short-term buying opportunity. I would expect some short-term consolidation here that eventually gives way to weakness. From here it looks like the 200 day moving average will be a buying point.

I mentioned the TLT chart on Thursday and Friday's unemployment data did indeed lead to a trendline break. I prefer betting on economic strength in the near-term by shorting treasuries. The move in yields is near its beginning while the stock market has probably overshot in the short-term. I have a position in TLT puts.

I have decided to stick to my guns on a dollar bounce. I think the sell off on Friday on good economic news is really the equivalent of the patient being pronounced dead. As I once heard Art Cashin say "Just when the patient is declared dead, he jumps up off the table." Those deeply oversold stochastics flatlining across the bottom should provide a powerful snapback in the event of a rally. Hopefully we will get an inside day (or a couple) to create some short-term stop loss points and allow an entry.

Part of my opinion on the dollar stems from the following commodity charts:

I believe oil makes up 15% of the CRB index but even so I think it says something that the equities and their underlying commodities all seem to be showing flagging momentum. No doubt about it that oil was the talk of the town a couple of weeks back and highs made in such circumstances are usually meaningful. I am , however, a bit surprised to see what looks like weakness in the entire CRB and particularly the metal stocks. Gold stocks in particular appear to be anticipating some metal weakness by not following the yellow metal to new highs. In this sector shorting oil and oil stocks makes the most sense but a dollar rally could be surprisingly painful for metal longs.

Nov 6, 2004

Where we came from

----

Hey ###,

Just wanted to pass along that a lot of people are beginning to see the possibility for a long countertrend rally in the dollar. The main premise is that something will squeeze the large build up of dollar shorts out there. My personal guess is some version of Chinese economic softness which leads them to push back the Yuan revaluation. All that needs to happen though is anything to spook the dollar shorts and there will be a substantial and largely self perpetuating rally. In here I am generally feeling like the trends from 03 are about to resume, with the exception of the dollar of course. That means gold and commodities up, yields down, and stocks up.

I can reconcile most of it with current low corporate borrowing rates generating a spending spurt similar to early 2003, generating growth and putting more pressure on commodities like steel. Oil prices have probably topped and if they revert to the mid 30's then tsy yields can stay low as people perceive the fed as having done its work. Most of thesis based on taking what the market feels like it wants to do and then trying to come up with some themes to fit. I have most confidence in the idea that either corporate yields need to rise or stocks need to rise.

And check out that VIX here. An alternate scenario would to continue this whippy grind lower in stocks for another 6 months as all the liquidity simply sloshes around the system while the economy deflates. I can't reconcile this with the low corporate yields though and lots of technical bears out there now because of the new yearly lows made in August. Just wanted to ping this to you as it is a bit different than what we talked about when I was there.

mike

---

The dollar rally never materialized but you did not need to be short until last week. I would say the markets have clearly selected the positive option with stock prices vaulting higher. Economic growth should accelerate for the next 6 months and 10 year yields will move higher, probably slowly. It seems like oil prices are contained and may head lower. I am not sure in here whether other commodities will be up with the growth or down and providing fuel for the growth.

My reason for posting this is to highlight just how similar this juncture is to the Spring of 2003. The easy borrowing for companies should lead to stronger growth than people are anticipating. I would then expect rates to move higher putting the brakes on again. In moments of doubt I will be expecting all the trends we saw then to emerge.

Nov 5, 2004

'bout time

So all the stocks that were up and immune to the great Oct '04 panic are getting plunked a bit. I guess it makes sense as positive break outs abound now and taking profits is usually an easy trade. Still not to fond of the market's short term prospects here and I will put in some effort trying to pick out some short candidates for Monday morning. They may be hard to find given the number of resistance levels snapped this week but it is worth a look.

I would keep an eye on the weak bond - weak dollar combo. Particularly with stocks so frothy. I have cost myself some money this week by not betting on momentum but I am sticking with that belief. There are just too many traders competing for each penny to create a stable trend.

Nov 4, 2004

Two more thoughts

KLAC is under the gun today with a brokerage downgrade and I would guess the pullback works to fill a gap between 43.5 and 43.

Big Bond Number

Lots of data next week with bond auctions and the FOMC meeting but I bet tomorrow's reaction around those technical levels sets the tone.

Wrong and Wronger

I expect equities to linger around the same levels today, maybe trading slightly up. I continue looking through volume scans to find stocks that have momentum and will try to add positions slowly. The last few days have been quite strong and I don't think very many people participated in the rally. The indices probably need a pullback and you are seeing a bit of that with the selling in the nets and semis but it remains to be seen if the market at large comes back. Remember two Mondays (a week and a half) ago when the insurance scandal was going to collapse the market? There will probably be more obvious buying opportunities ahead.

Nov 3, 2004

The dollar?!

Taking a bit of a wait and see approach here with the DXY at 84.75 which is below my stop at 85. I am still looking for a bounce but given the speed it has been moving and lack of near support I will try to buy it on a move above 85 with that level as my stop. The European currencies are doing much better than the Yen here with the Euro pressing 1.28 and the GBP tagging 1.85. AUD and NZD are doing well too at 0.755 and 0.689 respectively. These moves have gold and silver up.

Oil appears indifferent to the results even though some of the selling recently was attributed to a Kerry tapping the SPR to ease supply pressures if elected.

Elvis has left the building

Better trading opportunities are outside of equities for me. I did not feel that the election uncertainty or a possible Kerry victory was pressuring the market so it is difficult for me to have faith in the rally. The trading environment should remain the same with plenty of big swings around any trend that emerges.

History repeats itself

The oddest thing about it is that the NBC seems to be expecting Kerry to concede even though the vote difference in Ohio seems quite small relative to numbers for absentee ballots and provisional ballots. Andrea Mitchell is now saying that the provisional ballots are greater than the difference.

Nov 2, 2004

Oye!

"Secaucus - John Zogby’s polling was generally considered the most accurate during the crazed 2000 election, and if he maintains that measure of reliability, you can go to sleep now. Zogby's final tracking poll, state by state, released at 5:30 EST, suggests the prospect of a Kerry win by a margin of 311 Electoral Votes to 213, with only Colorado and Nevada too close to call (and representing just fourteen votes between them).

Oh and by the way, he has Mr. Bush winning the popular vote, narrowly- an irony of biblical proportions that one Democratic pollster rated a one-in-three chance just last week.

It should be noted Zogby is doing a lot of extrapolating. In the two from Column A (Florida, Ohio, Pennsylvania), two from Column B (Iowa, Minnesota, Wisconsin) states, he gives them all to Kerry. But Florida, Ohio, and Pennsylvania are listed as "trending Kerry" based on exit polling. The smaller three states show Kerry up by 5-6%."

Swinging

Maybe I will put some new trades on in the afternoon but for now am just waiting to see how high this rally goes.

Uncomfortable rally

Trading your emotions

If prediction is 10% what is the other 90%? Risk management. How to set stops and take profits to minimize your own emotional reactions. That is where the money is in trading. Taking profits when others are euphoric and having capital to buy when others panic. For me, a large part of this involves keeping position sizes relatively small and if I make a bigger bet I do it in the options market to cap the loss.

I have been reading my own posts and generally realized it fits pretty well into the "predict the markets" mold. While it is important to have a game plan and future expectations the actual position management is really what dominates long run performance. From now on I will try to focus more on that management. It may get cumbersome at times with repeated stops being hit in the same trade before I give up or the trend works out but I believe it will add value by seeing how good risk management actually creates the profits.

I called this post "trading your emotions" because that ultimately is what risk management accomplishes. It is impossible to tell if the market is irrational when you are not rational yourself. To keep my mind clear and open to both sides of the market I manage my positions so that I literally don't care which way the market moves.

Tonight's news

I wanted to post a chart of the commodity Research Bureau Index but am experiencing some technical troubles. It shows a double top over the last couple of weeks with a sharp stochastic divergence. It is heavily effected by oil but the charts of Gold, Silver, HUI and the XAU all show similar short-term weakness. And of course the dollar is sitting at support. All these things point to weaker commodities and a stronger dollar. It will be interesting to see how the market responds to the action. On the face it seems bullish as it shows that commodity prices are not out of control.

Nov 1, 2004

Launchpad

I would add to that foreigners may be less familiar with Bush and Kerry and may avoid election uncertainty as a matter of course. That might lead to a more tradable reaction in the currency.

The action so far

The oil move seems mostly like a trading phenomenon but there was weakness in foreign bonds overnight and we are now seeing weakness in US treasuries too. Bonds apparently giving back some of the "flight to quality" gains of last week. Metals are weakening after a higher open and perhaps there is some fear of weakening demand for commodities. Does not really fit with higher bond yields but bonds have been trading a bit counterintuitively with goods prices.

Still expecting some weakness in the semis and technology. If we don't see stocks give back some of last weeks gains I would probably view a Wednesday morning pop as a shorting opportunity.

Follow the bouncing ball

Also, the Reserve Bank of Australia, ECB, and Bank of England all have meetings this week. The election is distracting a lot of people but these meetings are significant because both Australia and Britain nearing the end of their rate hikes. At the turning points the markets will focus on nuances to see what to expect next. And of course the FOMC meets next week for what should be its last rate hike for a while.

Mostly I am looking through the election because it is ungamable. The candidates will only make subtle differences to the markets and even a tied election will eventually get resolved. Life will go on pretty much the same as it is today.