Bear Sterns chief economist David Malpass rubbishes the notion that the US does not save enough:

Not only are we not running out of household savings, it is growing fast both in terms of the annual additions and the cumulative buildup of American-owned savings. Household net worth, one good measure of savings, reached $48.5 trillion in 2004. Time deposits and savings accounts alone total a staggering $4.3 trillion, versus slow-growing credit-card debt of $800 billion. True, the U.S. is the world's biggest debtor, but it is building assets faster than debt. Even if household assets took a hard fall, the remaining net worth would still dwarf other countries'. On a per capita basis, counting mortgages but not houses, net financial assets total $89,800 in the U.S. versus $76,900 in No. 2 saver, Japan. Of course, some households don't have nearly this average, creating risks for them and burdens on others in the event of a downturn. This is an appropriate policy concern, but the macroeconomic issue is aggregate savings, of which the U.S. has an abundance.

According to the Federal Reserve's flow of funds data, the 2004 additions to household financial assets were a net $590 billion. This was 6.8% of personal disposable income, providing a meaningful measure of the cash flow going into new financial savings. This increased the household's financial net worth to $26.1 trillion, way above any other country's savings and plenty to fund profitable domestic investments. If the 2004 appreciation in the value of homes and equities were also counted, the 2004 saving rate was 46% of disposable income. Foreign savings invested in the U.S., the counterpart of the widely criticized current account deficit, is additive to our own large store of savings.

....

Meanwhile, foreigners are actually losing ownership share in the U.S. despite the $2.6 trillion net debtor position, since U.S. assets are growing faster than foreign savings in the U.S.

A couple of gut reactions that I have are, man if homes and equities give back 2004's gains that is going to be one interesting experiment in wealth's effect on consumption. And,"losing ownership share" sounds an awful lot like selling.

Brad Setser commented on U.S. borrowing and foreign investor disinterest in U.S. equities a while back.

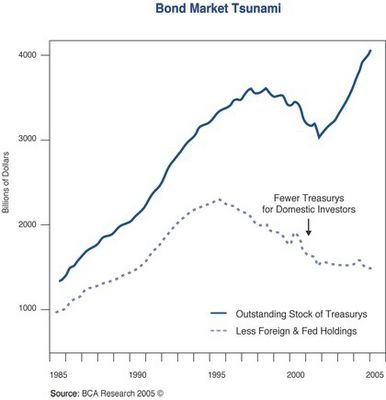

In broad terms, roughly $890 billion in net external debt issuance by the US financed the $666 billion current account deficit, $170 billion in equity outflows, and $57 billion in net outflows from banks and non-bank financial firms.Bill Gross provided the chart below in his Investment Outlook near the end of February.

Posted by Hello

It shows the shrinking share of U.S. treasury stock owned by U.S. private investors. Rightly or wrongly U.S. investors are focusing on carry trades to generate wealth. Malpass sees this as a good idea while I have my reservations.

Malpass has a valid point that perhaps the imbalances of the world represent an excess of savings relative to investment opportunities. U.S. interest rates have been set by the Fed and reinforced by the purchase of foreign central banks. Neither of these represents a market process so my concern is eventually markets will set base rates higher and turn carry trades into losers. The world economies dependence on U.S. consumption just heightens the risks if U.S. investors have taken on too much risk at the wrong time.

No comments:

Post a Comment