Posted by Hello

The DXY (Dollar Index) is oversold and coming into double support around 85 from the downtrend line and the '04 lows. Hard to see it bouncing past the 87-88 level and probably a good short when it arrives there. The longer-term downtrend has almost certainly resumed for the reasons given here and I continue to think the Euro and the Yen are better longs than the Pound and commonwealth currencies.

Posted by Hello

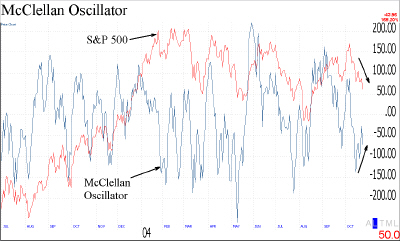

This is important because while the Dow appears in freefall toward the bottom of its channel the S&P does not look nearly as bad. This oscillator in particular shows that instead of gaining downside participants the market is losing momentum. A bounce above 1110 in the S&P without a new low for the oscillator would confirm a short-term bottom. Here is an explanation of the oscillator for those unfamiliar with it.

Definition from TC2000 - "The McClellan Oscillator is calculated by subtracting a 39 day moving average of (Advances – Declines) from a 19 day moving average of (Advances – Declines). It not only works as an overbought/oversold indicator, it works fairly well at making short-term trend changes when it crosses the zero line."

No comments:

Post a Comment