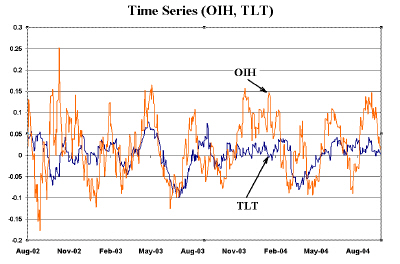

This looks like there really might be some correlation between Oil and Tsy bonds but a regression analysis makes it unlikely.

The r2 of this analysis came in at 0.05 and the scatterplot visually confirms that their is very little shape to cluster. The slope does seem to have a slight positive bias so maybe you could say that the bond market focuses equally on oils impact on inflation as well as the slowing effects on the economy of rising oil prices. Many times economic variables will show a better correlation of long periods (30 years) but for the horizon of my trade that is a bit useless.

I am posting this just to share what I found. Even though there is no relationship, knowing that is worth something too.

As for my trade I put it on as a long term position for economic reasons and kept it small so I could add to it if the market got carried away. This insurance investigation was not out then but I am still seeing it as contained to the issuers securities and not something that can effect the broader market over the medium term. Since this is my belief, I will stick with the original plan and continue to watch the financials (particularily their bond spreads) for evidence that I am interpreting the situation incorrectly.

The charts and analysis were done in Excel with the data coming from yahoo.

mike

No comments:

Post a Comment