This is a trading diary containing my views on international financial markets and economic news. I focus on the relationships between bond, currency, commodity and equity markets across countries. All ideas and opinions expressed here are shared for educational purposes. THESE ARE NOT RECOMMENDATIONS!

Oct 31, 2004

Weekly Game plan

For the stock market it feels like the semiconductors and NASDAQ are a bit overheated and may underperform. The cyclicals maybe a good place to look for the outperformance. Near the end the week it could be a good time to start putting out shorts in the financials. I think it makes sense to leg into a long term trade buying semis and cyclicals on weakness against finance sector shorts. FNM (Fannie Mae) in particular should begin a multimonth downtrend as it adjusts its business to new capital requirements and new legislation circulates in congress.

I see interest rates as a bit low in here but it I am not sure they are topping out yet. The commodity weakness could be perceived as a sign of the economy slowing or falling oil prices could be interpreted as stimulus.

Vols will probably take a sharp dip on Tuesday as the fears of terrorism pass.

Oct 30, 2004

More on Haliburton

I am very aware that all this news peppering the tape now is the result of Tuesday's election. It still seems to me though that all this attention is unwanted if you are an HAL holder. Very few large companies come out of these investigations without more bad news hitting. For CSFB and Arthur Anderson the investigation itself led to obstruction charges as employees sought to destroy evidence. And this U.K. investigation is certainly out of the control of whomever wins our Presidency.

With the other oil drillers being hit so hard by the move in oil while HAL hangs tough I will be avoiding HAL. Maybe there is a trade there and maybe not but for now it seems like dead money on the short side.

I will point out that the overall strength in yesterday's tape was similar to HAL's. October 31 is mutual fund year end so Friday was the last trading day. I am never quite sure how to gauge these events but it certainly could account for the inability of stocks to go down. The rollover in GOOG (Google) that caught a bid in the afternoon is another good example. That stock could easily have traded down another 5 or 10 points with no clear support until the top of its earnings gap at 175. Maybe on Monday.

Lastly, the dollar went out at the lows of the day, which also happens to be right near multiyear lows. It does look a bit scary but keep in mind that being short the dollar is the only trade in the world right now that everyone believes in. No lack of conviction there. With everyone on the same side there should be plenty of sharp rallies and these lows with the election as a news catalyst still seems like a good place to start one.

Oct 29, 2004

Synchronicity

The oddest thing here is that while the dollar has been willing to give up its gains from Tuesday, stocks have been well bid. Not sure I get it with the overhead resistance, sharp nature of the move, and of course looming election. Why buy vols but hold your stocks? Mine is not to question why I suppose.

I am still looking for a dollar rally and some metal weakness post election. Should stocks be down substantially on Monday I will make some selective purchases.

VIX

This election also seems to be occupying a disproportionate amount of people's radar. Most pundits agree with my view that the U.S. deficit is the controlling economic factor no matter who gets elected. Because of this I am viewing the trading chatter as representative of traders' emotional commitment to a particular candidate.

Lastly, and I realize I am contradicting myself, I have been toying with the thought that if Bush wins we are more likely to see the deficit used against us. The deficit is funded by foreigners and foreigners do not like Bush. Perhaps foreigners are cutting us slack because they recognize that while our gov't represents us it is not always representative of us. Should Bush win, that perception may change and foreigners may collectively feel the need to take matters into their own hands and curb America's belief that it can act unilaterally. The obvious result of this is the dollar trading lower while interest rates move higher. I have a hard time betting on this because such a policy by foreigners could have been used preemptively (where have I heard that phrase before) to wake up the U.S. electorate with higher rates before the election.

SPX update

Posted by Hello!

Passing time

This HAL (Haliburton) news should provide today's entertainment. HAL announced earnings 3 days ago and the stock gapped to a 2-year high. It was a difficult move to understand given the association between that stock and the Bush Presidency. Election is up in the air but if Kerry wins that stock will be under a microscope and forced through a lot of hoops for future contracts. Someone once said that the the toughest shorts are the best shorts and if that is true then HAL could break 30 today.

On an aside, I was paper trading HAL looking for a top in oil stocks and my loss on paper kept me from putting out many real shorts in the sector. The moves in the sector and this stock just highlight how willing market participants are to whip stocks around from day to day. Conviction and knowledge are trading at a premium in this market, trumping technicals. For me that means tight stops and a willingness to reenter the trade if my timing is off.

Oct 28, 2004

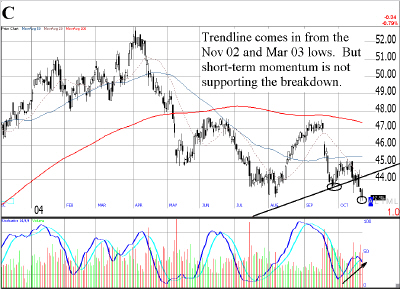

Fun with Citi

Citibank at 44 has retraced up near the trendline I pointed out last week and will struggle to get back above that bad boy but I would expect it to spend some time consolidating beneath it.

Still long some C calls but I have scaled out of 80% of the position.

Oil, bonds, the economy ... again

Expecting the Chinese to eventually hike rates was a no-brainer given their need to slow their economy. I will consider the mass selling of base metals that came out of China last week as insider selling and be on the look out for it as a future indicator.

On the front burner

I would guess the stock market stays range bound through the election and for the most part it is time to be building inventory on the dips. The financials, however, seem like a good sector for shorting but need to work through an oversold condition first. Not so much urgent today unless something you want to buy falls out of bed. The DXY should make it back near 87 so buying the dollar on dips probably makes some sense too. Metals (and metal stocks) are continue to fall this AM and some of them might make good purchases shortly when they are sitting at the uptrend or on a moving average. Copper stocks are better positioned for accumulation over the next couple days as they are oversold and near support.

An angry bear from left field?

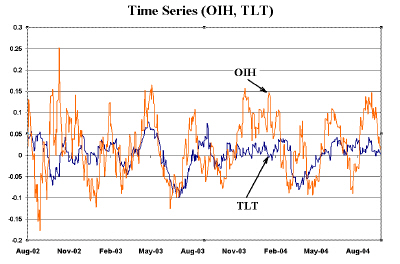

The "angry bear" has chosen to exclude the data from this Spring's massive bond sell off that occurred while oil prices continued trending higher. When searching for relationships like this it is important to have several up and down swings in both data series, otherwise you will find high correlations (or inverse correlations) for all series that are demonstrating trends.

There is something to the idea that oil prices are perceived by the markets as slowing the economy and causing interest rates to drop, but I think it is more a function of people trying to rationalize the low rates in a seemingly inflationary environment. Both trends appear to be breaking off now and I bet within a couple weeks the talk of their relationship will too.

British rates

Hedge fund reducing volatility

Maybe in the coming years funds will finally fight it out trying to slash investor costs rather than chasing performance.

Oct 27, 2004

Focus on the Fed!

However, with inflation quite low and resource use slack, the Committee

believes that policy accommodation can be maintained for a considerable period.

And in Jan 2004 it was changed to this.

With inflation quite low and resource use slack, the Committee believes that it

can be patient in removing its policy accommodation.

This change marked the end of the great bull market of 2003. Most people believe that the Fed is done with its rate hikes in November and with equal speculation circling about inflation and deflation it probably makes sense to stop here.

Whatever people may say remember that the overnight interest rate topped in May of 2000, bottomed in June 03, and is generally expected to make either a top or near term plateau next month. People may agree or disagree with Fed policy but it certainly seems to be driving the stock market.

Fed quotes and interest rate info is of course here.

This year's trend

I disagree that this is the market we are in. To me it seems like participants overreact to each piece of news. Or perhaps more accurately that they have very tight stops and simply are unwilling to sit with a loss of any size. Both good news and bad news are reflected in the stock price immediately. If you are not long when the good news prints you can not expect to hop in and make money. Same thing on the short side."One of the most striking features of the present chapter in stock market

history is the failure of the trading community to take serious alarm at

portents which once threw Wall Street into a state of alarm... Traders who would

formerly have taken the precaution of reducing their commitments just in case a

reaction should set in, now feel confident that they can ride out any storm

which may develop. But more particularly, the repeated demonstrations which the

market has given of its ability to 'come back' with renewed strength after a

sharp reaction has engendered a spirit of indifference to all the old-time

warnings. As to whether this attitude may not sometime itself become a

danger-signal, Wall Street is not agreed."-The New York Times Sept. 1, 1929

Lots of people talk about bubble part 2 as if the current prices and PE's reflect the lesson that stocks always go up in the long run. I see the lesson of the bubble as one of momentum. The most money in the bubble years was made by holding stocks while they went up and then selling them only after they rolled over. People made money on both sides of the market by following large multiyear trends. Then as a kicker you had a very steady march higher in 2003 which really reinforced the theme that momentum is simply the best way to trade. So last year was momentum and this year is a wide downward sloped range. Last weeks new DJI low brought out the Armageddon hats and the NASDAQ highs two weeks prior were proof that the range bound year was coming to an early end.

I tend to think this market action is constructive and probably more reasonable than momentum trading over the long run. You certainly still have some momentum stocks working (TASR, GOOG, RIMM...) but not the indices and not stocks in general. The best trading style for this market seems to be range trading with smaller than normal positions and tight stops. With low interest rates and overcapacity keeping profits small throughout the economy is there any reason to expect the financial markets to be handing out windfall gains?

Nightly charts

Posted by Hello!

I wanted to point out the bullish wedge forming in Japanese stocks. The EWJ (Equity Webs Japan) is a closed end fund that tracks the Japanese stocks and it has a very similar wedge formation to the Nikkei. Owning EWJ lets you benefit from both rising Japanese stocks and a rising Japanese currency.

Posted by Hello!

The next chart is the homebuilder TOL (Toll Brothers). The homebuilders had a pretty sharp correction in the past month but are gaining some impressive volume on this bounce. TOL appears to be making a cup and handle. It still has a long ways to go to complete a breakout but it caught my eye because I thought I would highlight it. A breakout in homebuilders would shock many people at this point (myself included) and would probably do a lot to effect psychology. Almost certainly cause the bears to lose a lot of the conviction they have had since the FNM (Fannie Mae) news came out 3 weeks back.

Oct 26, 2004

Them bonds

Bounce

You will also notice the rash of news stories about the election that will never end. Maybe but it is probably over next Wednesday and the market will take that as good news.

Position in C calls.

Feeling bullish

While investors intelligence numbers are skewed bullish (Approximately 80% bulls and 20% bears) the overall news and IMHO most trades still seem bearish. More than bearish I would say they are quite skittish and unwilling to maintain conviction in the face of contrary price moves. Many people express concern that the VXO is still around 16% which it is historically low but I am not sure that anticipating 20% per annum moves in stocks makes sense here. Rates are low, there is over capacity and the economy is taking its time to work these things off. Maybe people are correctly anticipating that economic volatility (both up and down) is falling off.

Many people are balancing their views between two negatives: deflation and stagflation. I am not so convinced there is not a more positive middle road that allows theU.S. to work through its capacity overhang and eventually become less dependent on low interest rates. My thesis is mainly based on structural changes taking place in emerging economies represented in some part by what we have seen in China. If the developing world begins to shift away from being a source of cheap supply and towards a source of demand that is what will happen. That shift is really all it takes to counter the deflation argument and turn stagflation into simple inflation. Then all that remains is to see that G7 central banks stick to their guns and moderate growth.

The main reason this IPO is bullish is that Wall Street has some overcapacity issues of its own. Hot IPO's like this feed retail interest and that will lead to more money flowing through Wall Street. Right now people on Wall Street seem to be the most bearish of all. The industry has done very little hiring in the last 5 years and any uptick could do a lot to change that morale. All of this will make the trading environment a lot easier.

Lastly, I keep thinking about the interest rate cycle. People were rabidly bullish in Jan 03, and now with markets very near the same levels 6 months later everyone sees us on the brink of a sell off. The rate hikes started in March and will end in November. If you had told me that the market would struggle to go up during the hiking cycle I would have agreed. It always does. I was bearish in Mar and essentially failed to make money because the sell off turned out to only be a side ways grind. This sideways grind made it difficult for everyone to make money and that lack of profitability is translating into a lack of hope. With the interest rate cycle changing I and the market apathetic it just seems that this sideways range will make a great base for a rally.

Oct 25, 2004

Where we started

The dollar is sitting solidly on support and many commodity sectors appear to be losing momentum while making higher prices. Most noticeably is the oil sector but the metal as well.

Interest rates are at a very important juncture retesting recent highs. Not much to predict which way they will move but perhaps a dollar rally will lead or be caused by a move in yields. I would much rather play that game via the currency than the interest rates at this point.

No positions in anything mentioned.

Planning ahead

Check out the chart for C from last week to see what I mean.

Heavy Betty

Still sticking with a bounce in the dollar which should lead to some weakness in metals / metal stocks. Probably makes sense to lighten up a bit on some semi longs and try to get them back on a pullback.

The housing stocks could get interesting in the next couple of weeks. It appears they are bouncing and I would expect it to fail but with rates ratcheting lower I suppose they have a shot at some new highs.

No positions in anything mentioned.

Some thoughts to keep in mind

Also, keep in mind that we are coming to the end of a hiking cycle by the U.S. Fed. The mantra don't fight the Fed was strong throughout the downtrend of 2000-01 and people got a bit tired of it. I have not really heard it once during the current cycle though the market has clearly been sailing into a headwind the last 9 months. It is still possible that we are at a point in the cycle similar to the 1994 cuts which also spooked markets quite severely. It may be that the marketing is waiting for a Fed bias change more than waiting to see who becomes the President.

Lastly the DXY is has made a straight line down to 85 and I would expect a bounce here.

Oct 24, 2004

Election arbitrage

Another interesting prospect is that for $13 you can sell a contract that will be worth $0 if Pres. Bush fails to win 350 electoral votes. The odds of that seem a lot smaller than 13% at this point. That contract has been falling steadily and it seems like it will continue.

Lastly you can buy a contract that Kerry wins the Rustbelt (PA, OH, and MI) for $38 while you can hedge by betting that Bush wins OH for $55. If Bush actually wins OH this combo pays you $7 and can only loose money if Bush loses OH but wins in MI (trading at $26) or PA (trading at 31). Other combinations like Kerry winning New England are trading much closer to parity against their weakest link. This is to say that if you buy Kerry winning New England for $55 and also buy Bush winning NH for $49 you have become a net loser just with the bid offer let alone the 5 other states Bush could win with one of them being Maine which is trading similar to MI.

All of these contracts have relatively wide bid/offer spreads so it probably pays to be patient and to expect to hold throught the election rather than trade in and out.

More on U.K. interest rates

Oct 23, 2004

Confirmation

Election news

Really the bottom? (DXY, SPX)

Posted by Hello

The DXY (Dollar Index) is oversold and coming into double support around 85 from the downtrend line and the '04 lows. Hard to see it bouncing past the 87-88 level and probably a good short when it arrives there. The longer-term downtrend has almost certainly resumed for the reasons given here and I continue to think the Euro and the Yen are better longs than the Pound and commonwealth currencies.

Posted by Hello

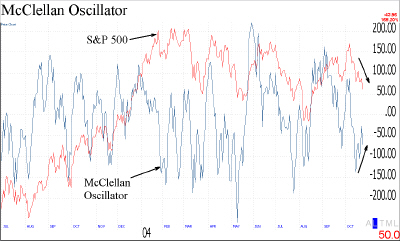

This is important because while the Dow appears in freefall toward the bottom of its channel the S&P does not look nearly as bad. This oscillator in particular shows that instead of gaining downside participants the market is losing momentum. A bounce above 1110 in the S&P without a new low for the oscillator would confirm a short-term bottom. Here is an explanation of the oscillator for those unfamiliar with it.

Definition from TC2000 - "The McClellan Oscillator is calculated by subtracting a 39 day moving average of (Advances – Declines) from a 19 day moving average of (Advances – Declines). It not only works as an overbought/oversold indicator, it works fairly well at making short-term trend changes when it crosses the zero line."

Oct 22, 2004

Into the close

Anyway as it swims against the tide today it is certainly a sign of some strength.

The Marshal Mathers plan?

Today's action is quite a bit more cohesive than yesteradays. The seller's have been building momentum all day and are now managing to steamroll the buyers. Would expect a bounce into the close as there has not been much dat-today follow through and intraday shorts will look to get flat.

This resting makes me sleepy

That the news in MSFT (Microsoft) and AMZN (AMAZON) is being contained to only those names is impressive. It should have been easy for the market to give back a chunk of yesterday's gains. The good news in KLAC (KLA Tencor) is also being ignored as the semis retest 400. AMAT (Applied Materials) seems particularly heavy.

Today sideways wandering is nearly the opposite of yesterday's broad intraday swings.

Metal Madness - Silver, Gold

Posted by Hello

Lots of people watching silver here but probably needs to consolidate a bit. I would guess it goes below the most recently low back to 6.50-6.70. The long-term uptrend will be kept intact and I think it would take some major policy changes (fiscal or monetary), to challenge that.

Posted by Hello

Ah the mysticism of the channel. It also appears capped in the short run as these two sisters trade together. They also both trade with the dollar and I would guess the first test of the summer DXY (dollar index) lows will hold and we will get a dollar bounce during the next week.

No positions in anything mentioned.

Oct 21, 2004

Charts for thought.

This is a chart of the oil driller APA (Apache). It has had a great run but appears to be forming a short term double top. Time will tell but it should get some good support around 48. Be patient if you plan to buy as momentum seems to be failing particularity hard these days.

Posted by Hello

FDX (Fedex) looks ready to head higher.

Posted by Hello

The trendline from way back is pretty powerful stuff but there does not seem to be very much follow through on the break. It looks like C (Citigroup)will need to test the trendline from beneath. I will reevaluate it if it does.

So that was an oil stock ready to pull back, a transport leader set to continue its momentum and a bank that seems overdone on the downside. I probably need to own a few more longs here as these are all bullish implications.

No positions in any of the stocks mentioned.

This means war!

My best guess is that markets with real issues do not lend themselves well to momentum trading. Just pull up the chart of AOC (Aon Corp) to see what it means to be on the wrong side when a problem hits. Momentum can keep the shorts at bay but that does not keep bringing in more buyers which are the necessary ingredient of an advance.

Mostly I think today is a good opportunity to pare risk both ways. The action wants to move fast in both directions and if it continues like this the VIX (CBOE Volitility Index) is completely mispriced. It is good to finally see some tradable moves occurring within a day but I am not sure the banks that are already under pressure are in a a position to deal with rising risks.

As the dollar weakens

And does the cyclical sell off really make sense given dollar weakness?

What a difference a day makes.

Hard not to see today getting good follow through on the strong opening. Should continue for weeks as we probably saw a washout yesterday.

Position in YHOO.

A new world order

``Who'll win the (U.S.) presidential race is important but whether the election ends smoothly is also crucial, and any disorder can become another market-unfriendly factor,'' said Daiwa Securities strategist Tsuyoshi Nomaguchi.

The quote was from here if you like reading about Japan.

And wasn't it just 2 weeks ago the Japanese FinMin was telling us that oil prices caused the yen to weaken????

Oct 20, 2004

Inflationary signs

If they do announce a secondary, I would expect the stock to dip quickly on the news. I would view such a dip as a buying opportunity. Off the top of my head I would guess the dip would carry to around 120-125.

I have no position in google, no relationship to the company and this is just a hunch based on the statements made around their IPO.

Analyzing Oil and Bonds

This looks like there really might be some correlation between Oil and Tsy bonds but a regression analysis makes it unlikely.

The r2 of this analysis came in at 0.05 and the scatterplot visually confirms that their is very little shape to cluster. The slope does seem to have a slight positive bias so maybe you could say that the bond market focuses equally on oils impact on inflation as well as the slowing effects on the economy of rising oil prices. Many times economic variables will show a better correlation of long periods (30 years) but for the horizon of my trade that is a bit useless.

I am posting this just to share what I found. Even though there is no relationship, knowing that is worth something too.

As for my trade I put it on as a long term position for economic reasons and kept it small so I could add to it if the market got carried away. This insurance investigation was not out then but I am still seeing it as contained to the issuers securities and not something that can effect the broader market over the medium term. Since this is my belief, I will stick with the original plan and continue to watch the financials (particularily their bond spreads) for evidence that I am interpreting the situation incorrectly.

The charts and analysis were done in Excel with the data coming from yahoo.

mike

In a tizzy

I am still in the show me camp about this issue but will be probably try to hedge my views by shorting the banks on a bounce. The semis still need to base out a bit in my view but they may be a good place for shopping. And I am getting a bit worried that gold and gold stocks will not pull back this week as i had hoped.

Position in TLT

mike

A few ideas

It may make sense to short the bank sector or buy bank puts against other positions because if this insurance stuff pulls us down it will be short, sharp, and focused on the banks. Maybe short some GM for good measure as it makes most of its money of GMAC and has got some definite issues in the pipe with this pension investigation.

The put/call ratio is a bit low given the position of the indices. It sure feels like everyone is worried in here but I would like it better if that number were 1.3 rather than 0.9.

Despite the angst we stayed above 1100 which will look very bullish if we manage to bounce.

No good news overnight apparently.

The Nikkei appears to be following suit on todays action with some extra fuel from the Citibank firing. Should come into strong support at 10600. We will probably get a chance to see how it holds up shortly.

Oct 19, 2004

Bark or bite?

Lots of people talking about election risk but I think the risk is more in the process than in the outcome. Seeing stories daily now about various start dates for absentee ballots. That combined with law suits being fought about computer voting and new laws make me think the media is going to recreate "Indecision 2000" before the voting even starts. Probably more hype than anything until election day actually arrives.

The cat ate my homework!

The market is getting tanked by the financials here. This probably has legs to keep the market weak for a couple of days because of the widening credit spreads on insurers. The best article I have seen on the implication is at this pay site.

Alan Greenspan spoke on the consumer debt levels and the housing bubble and basically said not to worry. His arguements are plausible but these problems are probably a headwind for the U.S. economy. A more bearish prognostication was made in August by Stephen Roach.

Keep watching that USD/JPY!!

Wrap up

The charts I posted today are all shorts but they are all in sectors that have been market leaders. Maybe just more volatility (better to trade) on both sides while other sectors are caught in doldrums.

Maybe the whole market is in the headlights as we head toward the election or maybe just testing everyones patience. Their seems to be a lot of that this year.

Have a great night.

mike

Is Google eating their lunch??

Perhaps a short looming here. This is a volatile stock so a smaller position and wider stop may be necessary to participate.

A vote for Kerry?

Could this be an election trade? It looks like it is heading for 200.

I am only relating this to the election by the old axiom that Republicans are tougher (and spend more) on defense. The election is still up in the air and both candidates are talking strong on defense but given the run up it has had it seems like a good candidate to have an adverse reaction to a Kerry victory.

Oct 18, 2004

Is this tape is wishy or washy?

-early weaknes in semi's got bought

-early strength in metals got sold

-weakness in bonds got taken up by Olson's negative comments

-LXK mentioned earlier is digging out of this morning's hole

On the whole the action could have gotten much worse considering how the day started so I would call today a minor victory (so far) for the bulls. Mostly we appear to be waiting on tonight's earnings which makes initiating positions seem a bit pointless.

no positions in any security mentioned

mike

Trifecta!!

Catching the knife

Some stocks with better patterns are ALTI and RANGY. Both in materials but ALTI probably will be treated like a tech stock from time to time. Both are penny stocks and subject to big percentage moves but the charts by themselves are nice.

no positions in anything mentioned.

mike

Morning Notes

CSFB is downgrading the Steel sector saying that the demand imbalance in the U.S. is being corrected and that China's economy looks to be slowing. There will probably be some good shorts in the sector soon if they can bounce a bit.

The dollar is moving a bit to the downside mostly against the Euro. The story of India's reserves does not seem to be getting much chatter but I think it will probably come to the fore as people look to figure out why the dollar is breaking down now.

For the record, I have no positions in anything mentioned here.

mike

Oct 17, 2004

Caterpillar (CAT) is big enough to lead the market.

Since I spoke about CAT I thought I would show it. It is getting a nice lift here but it will probably need some stronger volume to break through 85!!

Election Crunch

Since the debates ended pundits have been spending a great deal of time analyzing Kerry's "outing" of Cheney's daughter. It is a bit amusing that it is taking air time away from the investigation into the administration's "outing" of a CIA spy. While the spy case will not reach the President or V.P., the leak was in response to Bush being called out for talking about Nigerian "yellow cake" in his State of the Union address. I recognize the need for the media to give equal time and their desire to make the election a horse race but at some point it stops making sense to weigh each candidate phrase by phrase and action by action without taking into account the ramifications of those actions. The two political maneuvers are not even in the same league and yet the air time is all going to Kerry's insensitivity.

On to the Bigger Question.

For the markets it is difficult to see either candidate making much of a difference. The deficit is too large and the global forces of my previous post are too strong for the US to do anything but struggle. Kerry's plan to move "catastrophic" insurance costs to the public sector seems promising because if he does manage to curtail healthcare costs that will improve U.S. competitiveness tremendously. Kerry needs to spend his entire tax hike though (and maybe more) which ensures that the risk of capital flight from U.S. markets remains high. Deficit, deficit, deficit.

The flipside, to me, is Bush's overwhelmingly bad track record. It was going to be a bad 4 years no matter what but he has spent too much on projects (Iraq war) which that have no monetary payoff. The short-sighted nature of his decisions means he could probably still make things worse. While the deficit growth has produced a lot of hand wringing by market watchers it has not had an impact yet and interest rates remain low. A Bush re-election alone would not alter the markets perceptions.

Oct 16, 2004

Getting Started

Today's news

This morning the news is about India's possible change in foreign reserve policy. India has $120 bn in foreign reserves, most of which is invested in US Treasury bills, and is considering investing them in domestic infrastructure projects instead. This makes good sense in theory because definite need in India for infrastructure improvements (roads!) and the dramatically lower return on investing in the US compared to India. Whether this is good or bad for India will be determined by the specifics of the spending but it is significant to the markets because of the similarities between India, China, and Japan. Since the start of 2002 China and Japan have purchased a combined $240 bn of USD assets while Chinese and Japanese foreign currency reserves total $450 bn and $650 bn respectively.

Will it matter?

If China were to change its reserve policy financial markets would certainly react but right now all we have is India considering changes. My opinion is that it will probably make the dollar trade down against the Yen and the Euro. Not an earth shattering call in here but it is really more an issue of timing than direction. The dollar was already down a bit yesterday and Monday should continue the move. This should also benefit gold and other precious metals but personally I would wait a few days to see if last week's weakness reappears. I also plan to watch Caterpillar (CAT:NYSE) closely in here as it has a bullish chart, a CEO who has "never seen such a strong economy", and the possibility of a ramp up in Asian infrastructure building. China probably has more need of roads than India if they were to follow suit.

Not the end of the world.

Contrary to popular opinion I am not so sure that the repatriation of Chinese or Japanese funds will cause any sort of financial collapse. A strong argument could be made that this repatriation is what the Federal Reserve and US gov't were hoping for by letting the dollar depreciate. Such a policy change would mean that the US consumer is no longer the growth engine of the world and that the US could then be pulled out of its jobless recovery by exporting goods to Asia. Probably some short-term adjusting to be done but I don't think it leads to an inflationary spiral for the US or the world.

Bullish or bearish?

As the above comments reveal, I am leaning a bit bullish on US equities in here. A change in Indian reserve policy would be the second major "bearish" occurrence in two weeks (the first is the FNM restructuring). I believe this Indian policy change (if it actually occurs) will pass relatively quietly and if China should follow suit in 6 months that will be accepted too. The passing of these events without massive US inflation or deflation can only be interpreted as bullish. Obviously I am looking ahead here and am still very open to changing my mind (say if the yen trades below 103/$ in the next month) but to me the global imbalances are showing signs of correcting in an orderly fashion.

Thanks!

Thanks to Google for hosting this and to anyone who takes the time to read my first post.

BTW, I have no positions in any assets mentioned in this post.

mike