All charts posted with Hello

The story of the week is the breakout in all the major U.S. equity indices. While I do think that over time the economic numbers will justify the equity advance, I would expect the uptrend to look a lot like the downtrend we just went through. The SPX made new lows three times this year and each proved to be a short-term buying opportunity. I would expect some short-term consolidation here that eventually gives way to weakness. From here it looks like the 200 day moving average will be a buying point.

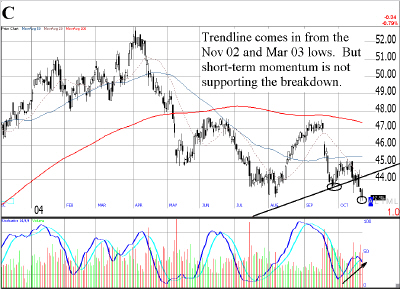

I mentioned the TLT chart on Thursday and Friday's unemployment data did indeed lead to a trendline break. I prefer betting on economic strength in the near-term by shorting treasuries. The move in yields is near its beginning while the stock market has probably overshot in the short-term. I have a position in TLT puts.

I have decided to stick to my guns on a dollar bounce. I think the sell off on Friday on good economic news is really the equivalent of the patient being pronounced dead. As I once heard Art Cashin say "Just when the patient is declared dead, he jumps up off the table." Those deeply oversold stochastics flatlining across the bottom should provide a powerful snapback in the event of a rally. Hopefully we will get an inside day (or a couple) to create some short-term stop loss points and allow an entry.

Part of my opinion on the dollar stems from the following commodity charts:

I believe oil makes up 15% of the CRB index but even so I think it says something that the equities and their underlying commodities all seem to be showing flagging momentum. No doubt about it that oil was the talk of the town a couple of weeks back and highs made in such circumstances are usually meaningful. I am , however, a bit surprised to see what looks like weakness in the entire CRB and particularly the metal stocks. Gold stocks in particular appear to be anticipating some metal weakness by not following the yellow metal to new highs. In this sector shorting oil and oil stocks makes the most sense but a dollar rally could be surprisingly painful for metal longs.