Watching HSY puke on the news that it will be hiking prices. I certainly had the right thought a couple of weeks ago about their costs being under pressure but I got stopped in a heartbeat. You'll notice in the link that PG had to raise the price of coffee so my SBUX thought (stopped there too) wasn't so far off either. That stock (SBUX) is in a flag pattern that may lead to an entry when it chooses a side. The "book" says it should resolve with the trend (up in this case) but maybe not.

On to today's business...

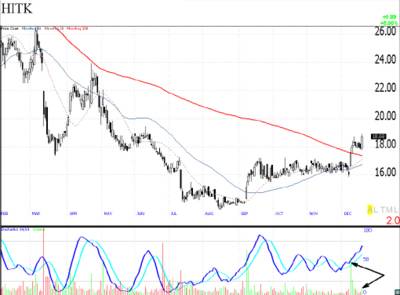

Click on the chart to see a larger image!

HITK looks like a pretty standard momentum bet. I would put the stop at 17.80 and hope to take some profits at $22.

AIG looks like a classic short as it is finally back to where it got "Spitzered". Might take a bit to rollover so maybe play with a half position stop at $66 and a full stop at $68 (or the 200 day). Long term the insurance industry is probably going to look different than it did before the investigations and with Greenberg's son being forced to step down from MMC and investigations underway into AIG I just don't see the company returning to business as usual. Either way there is supply overhead here so it makes for an interesting risk-reward tradeoff.

No comments:

Post a Comment