This is a trading diary containing my views on international financial markets and economic news. I focus on the relationships between bond, currency, commodity and equity markets across countries. All ideas and opinions expressed here are shared for educational purposes. THESE ARE NOT RECOMMENDATIONS!

Dec 29, 2004

Bonds

The flipside is that it is a holiday week. I would guess we will retrace some of the move next week giving a short entry

Still Awake

Click on a chart to see a larger image!!

MMM looks like it will soon join the likes of GE and TYC in their uptrends. It is still below resistance but having cleared its 200 day moving average it appears to be carving out a near-term bottom.

SYNM also looks like it will soon be reaching for new highs. Has a nice tight risk-reward ratio while it holds above the recent gap.

Overall I expect the beginning of next week to be strong. Maybe some risk that we get a delayed negative reaction to the tsunami but seasonality and a well-rested uptrend should win the day. The semiconductors may be a good long in here as they are due for some rotating capital. I mentioned some head and shoulders patterns in AMAT and KLAC a couple weeks ago but the necklines have not been violated. The failure of that pattern might have left shorts squeezable.

Dec 28, 2004

Same Ukraine, Different Candidates

The data I was looking for is available on the World Bank site.

Thoughts for the New Year

The biggest effect though will probably be in interest rate markets. Japanese O/N rates have been at zero for the better part of a decade and in my mind have been pulling global interest rates lower. The world has essentially struggled with the deflationary effects of negative growth in the second largest economy. That struggle may be over. This sort of shift in rates should cause some real pressure on peripheral borrowers and I would expect some spread widening in emerging market and high yield bonds. Many people looked at 1994 to see what might happen when the Fed began raising rates in early 2004 but this year's rate hikes were met with spread tightening. I don't think the same thing will be true when/if Japan begins moving rates up.

I would guess that all this and the development in emerging markets is setting up a pretty strong resurgence in macro trading.

Dec 22, 2004

Hand Sitting

This morning the GBP took a solid thumping. Below 190.13 it will complete a double top against the USD. I have been playing around short the AUD against Yen (stopped a couple days back) and am now playing a bit short GBP against Yen. Neither chart really shows trend lower yet so I am just getting involved a bit and hoping to put on some more substantial trades later.

I am watching the second upgrade of the precious metals stocks in two days and wondering what is going on. Are they upgrading them for technical reasons? Was I simply noticing some sort of pre-upgrade accumulation? Who knows I guess. It is a bit annoying as I prefer being active in a vacuum to buying into upgrades. The charts still look nice though.

Dec 21, 2004

Beneath the Hood

Click on the charts to see a larger image!!

Some of the individual charts in the HUI look like they are finding some footing. This chart has stochastics crossing at the bottom but I would prefer to see one more touch of the 200 day while the stochastics keep their buy signal. Might start to dabble on the long side in some of the smaller names soon.

This chart in OS (Oregon Steel) bodes well for the market. Particularly with CMC joining in the breakout today. As the market overall felt weak Friday and today I think it is a good sign that the steel stocks can resume their rally. Makes me more comfortable buying into this pullback. I am also watching FCX in here to see if copper can manage the same trick.

After not doing a whole lot and seeing little to even talk about today I was mildly surprised by going through the charts. I noticed short-term head and shoulders in AMAT and KLAC. I also noticed several stocks (RFMD, NVTL, RHAT...) I had flagged to watch for upside breaks instead broke down. Depending on what happens in other markets, this pullback could lead to a buying opportunity between Xmas and New Year.

Some other odds and ends here. F appears to be breaking out to the upside here even though GM is going through some tough news with this Fiat put. GM appears to be basing too so I am wondering if this is a case of the tape leading the market. I have not heard positive comments on any auto stock (except maybe TM) in a long time.

Lastly, the 5-yr is easily holding its uptrend while its stochastics have almost worked back to oversold. May not head higher immediately but it is hard to see that pattern heading lower from here. Like the steel sector, that seems quite bullish. Maybe just more flattening though.

Dec 18, 2004

Lost in the Social Security Shuffle

Social security is a welfare program, not a retirement program. Always has been and always will be. It is a social contract between generations, with the young funding on a pay-as-you-go basis an honorable duty to protect the old from a destitute journey into life's sunset. As a matter of financial architecture, Social Security is not anything like the ERISA-grounded retirement plans for which PIMCO manages huge portfolios.A more detailed description can be found in Prof. Robert Shiller's book. Altering the Social Security system will have a lasting impact on our country no matter what happens and I find it unnerving just how far the public dialogue seems from reality.

Dec 17, 2004

Bitter Irony

Watching HSY puke on the news that it will be hiking prices. I certainly had the right thought a couple of weeks ago about their costs being under pressure but I got stopped in a heartbeat. You'll notice in the link that PG had to raise the price of coffee so my SBUX thought (stopped there too) wasn't so far off either. That stock (SBUX) is in a flag pattern that may lead to an entry when it chooses a side. The "book" says it should resolve with the trend (up in this case) but maybe not.

On to today's business...

Click on the chart to see a larger image!

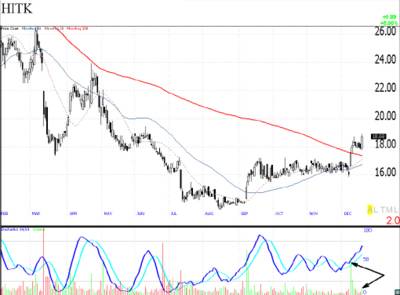

HITK looks like a pretty standard momentum bet. I would put the stop at 17.80 and hope to take some profits at $22.

AIG looks like a classic short as it is finally back to where it got "Spitzered". Might take a bit to rollover so maybe play with a half position stop at $66 and a full stop at $68 (or the 200 day). Long term the insurance industry is probably going to look different than it did before the investigations and with Greenberg's son being forced to step down from MMC and investigations underway into AIG I just don't see the company returning to business as usual. Either way there is supply overhead here so it makes for an interesting risk-reward tradeoff.

Dec 16, 2004

Breadth

We have put in several strong positive days negative and flat breadth and I had been thinking the narrowing breadth may continue with the rally. This makes it really tough to trust the upside. Yesterday made me think maybe the breadth was going to catch up and give some real vigor to the upside but today is dashing that thought on the rocks pretty good.

Morning Take

Bonds in the U.S. are giving back some love from the last couple of days. Yields are really whipping around lately and I see it as mostly trader vs. fundamentally driven. I think that the steepening and yield increases are good for stocks to a point as it demonstrates that bond investors see economic growth. I would guess the 5-year can approach 4% before people need to be too concerned about leverage problems.

FNM is holding up well after last nights news but the real story is whether it can stay near $70 after options expiration on Friday. I am also trying to keep an eye on agency spreads as the nearness to year end could create knock on selling if traders are hit with a sudden loss.

Spice Up Your Expirey

The other interesting news I see is that GM spreads are widening because of the dispute with Fiat. The story contains this gem:

GM is already under pressure from weak vehicle sales in the US and large pension and healthcare liabilities. Following disappointing third-quarter earnings, Standard & Poor's downgraded the company to Triple B minus, the lowest investment-grade rating.

The rating agency said on Tuesday it was concerned about the potential ramifications of this situation for GM's credit quality, adding that a downgrade to junk status was unlikely - but could not be discounted. Its outlook is currently "stable.

GM's stock has been looking like it wants to bottom but it is still below the 50 day average and well within its downtrend for the year. A bit difficult to see why bank shares would have been so strong today in the face of these two stories which seem to go pretty straight to the risks in the banking sector.

Dec 15, 2004

Not much to add

Of these the commodity weakness seems like the best play. The CRB is still above its 200 day but a break below might open up the flood gates. It may also lead to shorts in some emerging market equity indices.

I don't trust bond strength here because of the currency exposure. I would rather play in German bunds for yield bets. Maybe the U.K. gilt market.

I don't trust the stock rally either as it feels like a house of cards. Maybe I will watch for a while and try to select some companies to buy stock and short bonds in. Ultimately it seems like the corporate bond market is the goat in this game.

Planning not to be very active in the short run.

A Short?

Click on the chart to see a larger image!

With lots of chart showing positive momentum I thought I would buck the trend and show some negative momentum. ROP appears to be consolidating beneath its 50 day average and looks like it will head towards its 200 day. The recent narrow range makes for nice risk management.

Today my thoughts keep drifting back to a story on the newswire yesterday that the yield curve was now as flat as it was in 1998. That is the 2-yr to 10-yr spread is now at 1.16%. This shift in the yield curve is really difficult to relate to the strength in equities and especially the financials which are trying to lead the tape higher today. To reconcile these two views inflation will have to evaporate while economic growth continues. Maybe this will happen but it is difficult to understand why it would. This is even more difficult to reconcile with the banks as ebbing inflation would renew the risk of deflation which puts their loan portfolios at risk.

It makes a lot more sense to me to explain the moves as stocks flying up as corporations borrow at low yields to manage their stock prices via buybacks and mergers while banks benefit from fee generation. This increases the exposure of the stock market to even a slight bump in corporate yields and it is happening while the bond market looks like it is anticipating an economic slowdown.

A good trade here might be to pair an equity short(probaby in 6 month options to limit the risk) with a curve steepener.

In Case You Missed It

Click on the chart to see a larger image!

With the Fed results being widely expected I think RIMM was really the show for the day. The chart we are left looking at on a daily basis is a disaster. It has just failed a cup and handle breakout with a massive bearish reversal on big volume. Look out below! I expect RIMM to test its uptrend line and probably 200 day on this trip lower.

More important for the market was the nature of the reversal. A story broke in the morning that an appellate court had remanded part of a lower courts decision back to the lower court but gave no more details than that. On this highly ambiguous news traders ramped the stock 10% to a new all time high. Then the stock was halted. Next the details of the court decision came out and the important portions of the lower court ruling were intact. Then the stock remained closed a couple more hours and opened on a 8 point intraday gap below its open. It is hard to view this reaction as healthy, particularly occuring on a Fed day.

This type of action was not restricted to RIMM as GE had a similar - though far smaller - run up and fall back on the release of slides prior to today's annual presentation. GE is not normally the vehicle of choice for hot trading but people were eager to get involved first and ask questions later.

I really preferred yesterdays grind higher to these whippy moves.

Dec 14, 2004

Double Double

Click on the Chart to see a larger image!

Just putting this up for perspective on how little this bounce means in the grand scheme of things.

Same story here. Both charts seem like they will need to test recent lows if they want to reverse the trend. Also if you look at the two of them you will see just how much of the gains commodities gave back relative to a shallow USD bounce. That is why I think commodities are reacting to some sort of deeper economic weakness. Maybe they are just more volatile and will quickly be setting the pace with new highs again but the charts in some (particularly silver) do not seem like charts that can move up without regaining their footing.

This commodity bounce matched nicely with today's equity rally but again, the S&P made a new 3-yr high while commodities are looking up out of a deep hole. The strength in stocks was concentrated in the cyclicals (GE and UTX) but by the end of the day it managed to pull the banks into it. C broke its 200 day moving average and is targeting its 3 month high at 47.09 and JPM looks well positioned to break its 200 day moving average shortly. The BTK is breaking out nicely from a near term inverse head and shoulders. Clearly all this is a sign that the equity market wants to go up no matter what the cross currents are in other markets.

Tomorrow is Fed day and with today's big move higher I would think we see profit taking at some point prior to the 2:15 announcement. Maybe we make a higher high in the morning but locking in some profits before 11 AM is probably a prudent move. I see no reason to initiate positions until after the meeting. The market views on the FOMC announcement seem pretty concentrated around a 25 bps hike and repetitive comments so I think with the equity run up in the face of the meeting there is extra risk associated with anything off script. Hard to imagine the market won't at least test lower hard (5 S&P points) in the 15 min. around the announcement no matter what is said.

Dec 13, 2004

And They're Off!

The Fed meeting may put a damper on things today or early tomorrow as people take risk off their books for the meeting but I would not count on it.

Seeing a bit of curve flattening in bonds as 5s anad 10s come off while 30s just don't care. Probably just the weaker dollar. Keep in mind this is how the last move higher in yields started.

Thoughts on Tomorrow

The market has remained quite buoyant in the face of a various negative stories and in particular the semiconductor news last week. The banks which underperformed in the November rally have not broken down and seem to be getting some of the money that is flowing away from tech. GM, a defacto financial, that also has not participated in the rally also appears to be putting in a near-term bottom. Churning while pulling up the laggards seems pretty positive. Also in this category is the biotech sector which has not made new highs with the NASDAQ but now appears to be attracting some positive attention. The action in the housing stocks is certainly bullish too. It is hard to see where the housing demand is coming from as retail and durable goods numbers are disappointing but TOL is sure selling to somebody.

That said the breakdown in commodity prices (silver) and their related stocks could be interpreted as anticipating slowing Chinese growth. There have also been several negative fundamental data points out of Japan since the November rally began. None of this has shaken the U.S. equity markets but if this rally isn't based on global growth being strong, what is it based on? A bullish scenario here would be if the metals stocks based near last weeks lows and then resumed uptrends. The rise was steep and this pullback has not done real damage yet but it can not go much deeper. The breadth has remained negative even through rallies.

I can really see the market going either way here but on the whole it is convincing me it wants to go higher. Maybe speculation on the Fed will make for some interesting moves tomorrow but it is probably best to wait until Tuesday to make any judgments. My best guess is the Fed issues exactly the same statement after this meeting as they did after the last.

Lastly, in the recent dollar rally the Canadian $ and Aussie $ topped early. With the pound not moving with them I am not quite certain it means anything but I can't help wondering if it is a sign that the market is beginning to figure out which countries will be lowering rates. If the dollar has found a bottom here perhaps those currencies will be the weakest. If the dollar has not found a bottom I would still watch to see what the do near highs to see if the dollar weakness will finally transfer to Asia rather than anything that floats freely.

Dec 10, 2004

Good Reading

Attorneys for Mr. Skilling have asked Houston federal judge Sim Lake to make public the names of 114 people who the government alleges in a sealed document were co-conspirators." - WSJ By John R. Emshwiller

I doubt Skilling will succeed in making the names public but if he did it would provide months of entertainment.

Vimpelcom - Learn It Love It

Something similar happened in the MinFin bond market back in 1996.

In the countdown to Russia's Eurobond placement, Potanin met with various government agencies Saturday and gave them just 10 days to solve the mounting problem of so-called "frozen" domestic Finance Ministry bonds.At the time the markets became extremely upset with the governments seizures and ultimately forced a full about face by the gov't. Even so repo rates on the bonds in question never returned to normal as market players were too afraid that a new bond seizure would create a liability on borrowed bonds. Apparently the markets have a different view of the current actions or are better equipped to bear the risk.The frozen MinFins emerged as an untimely threat to a successful Eurobond launch and have rattled international investors eager to snap up Russia's newest issue.

Russian police released figures last week showing that authorities have seized about $74 million of dollar-denominated MinFins this year as part of criminal investigations.

Prices of Finance Ministry bonds fell last month when news broke of $57 million in face value frozen MinFins seized by police.

Prosecutors had ordered the $57 million in MinFins frozen as part of a criminal investigation, a senior official with Vneshtorgbank confirmed soon after the seizure.

The later pool of frozen MinFin bonds, about two-thirds of which are held in custody by Vneshtorgbank, adds to the $24 million of suspected stolen bonds frozen in June.

At the center of the problem is a conflict in Russian law. The criminal code allows investigators to seize property until the rightful owner is determined.

But the civil code states that a bona fide holder of the securities should be free from any previous problems.

"If these bonds can be frozen anytime, every bond becomes a risk," said one London-based MinFin dealer last month, who did not wish to be identified.

Oil Output Cut

Headlines of Interest

Sprint and Nextel are reportly considering a merger as equals. The total value of the deal is estimated at $70 bln.

Today's 10-year auction did not go off as well as yesterday's 5-year. The foreign participation was around 3% compared to yesterday's 60% but some say this may be due to the auction being a reopening rather than a new issue.

There is a bit of a scandal developing about how the Coalition Provisional Authority in Iraq spent $20 bln dollars of Iraqi national savings in the last couple of weeks before control was transferred to the interim gov't. $20 bln is larger than the Iraqi GDP. Apparently the funds were sourced in the way they were because of strict controls on all of the money coming from the U.S.

Today's market action leaned to the bullish side in my view. The market did continue the trend of lower lows and the breadth was not great but the semi's managed to climb back above the 50 day after bad news and there were a fair number of stocks making new highs. The most bullish thing in my mind is really the emotional swing we went through and the fact that this mornings despair came while still within' spitting distance of new highs. We shall see. I have been expecting the breadth and bad economic data to bring stocks down and as this view seems wrong I will probably try to step back and collect my thoughts before taking any action.

Dec 9, 2004

Tennis Match

Stocks are amazingly sanquine as this game in interest rates and currencies seems pretty evenly contested and the outcome will have sweeping implications for equities.

Three Things

Last night both Altera and Xilinx missed badly on their mid-quarter updates adding to the inventory problems already highlighted by Texas Instruments.

Oil is trading higher on a new weather forecast for the U.S. involving the word "arctic". I keep watching the stock market rationalize it ups and downs with the price of oil and wondering when it will stop. The bottom line is that the high price of oil was a drag on the economy which kept bond prices lower than they should have been. Even with that drag the Fed has been hiking rates. In a vacuum lower oil prices stimulate the economy but the Fed knew this when it hiked in Nov and it will know that when it hikes in Dec. As for the story at hand I don't think the Arctic blast will have a lasting effect on the price of oil.

Sending Our Love Down a Well

It is a tough call here whether fighting a bunch of central banks (or in my case picking sides in a fight against central banks) is the right thing to do or not. The only reason I would consider it is that other central banks (Russia, India, Indonesia...), some sizeable institutional investors, and those greedy bastards at OPEC are all taking my side. Also, the central banks doing the buying are already long and wrong. With gov't backing they may not need to stop out as quickly as some but they feel pain just like any investor and they have limits. The Fed meeting should really get interesting as I swear Fed officials have been doing their best to talk rates higher and getting no results.

Dec 8, 2004

Levitation

Click on the Chart to see a larger image!!

Throwing up the SMH chart after the bad news from XLNX and ALTR. I will be impressed if the SMH can stay above its 50 day tomorrow but we shall see. The inventory problems they talk about shouldn't surprise anyone but even so they are missing guidance by a fair bit.

Watching the QQQQ's trade down in the after-market and wondering who was brave enough to buy them during the day but afraid to hold them through these company reports. I thought this morning's open was pretty intimidating but maybe that was just me. Perhaps equities will make an effort to catch up with bonds tomorrow. Let's see the 10 year note has jumped back up near its Nov. 2 level over the last 4 days so...

Krugman on Social Security

"Right now the revenues from the payroll tax exceed the amount paid out in benefits. This is deliberate, the result of a payroll tax increase - recommended by none other than Alan Greenspan - two decades ago. His justification at the time for raising a tax that falls mainly on lower- and middle-income families, even though Ronald Reagan had just cut the taxes that fall mainly on the very well-off, was that the extra revenue was needed to build up a trust fund. This could be drawn on to pay benefits once the baby boomers began to retire."

That's Funny!

Levels for Watching

-- 105.13 is the level the yen broke down from 2 weeks ago.

-- 4.15 is where the UST 10-yr yield's 50 day moving average is and 4.2 is the uptrend line from from the october lows.

Figuring It Out

My best guess is that one of the Asian countries bought a healthy chunk of bonds last night. This moved the dollar but had a bigger impact on bonds because traders were still wrong footed from the jobs report Friday. Stocks are reacting with relief to the idea that the status quo is going to be maintained a bit longer. And commodities are in their own little world as Asian growth is disappointing and the dollar is not collapsing tomorrow.

There is some talk about deflation today with commodities off and bonds up but that view is tough to accept with stocks going higher. Deflation would be crushing for equity holders and maybe more importantly here, corporate bond holders. I would imagine the movements of a foriegn central bank would make it into the papers eventually if that is really what happened.

Before the Open

The Fed meeting next weekcould be one of the most interesting we have had in a while. I am positioned for lower stock prices and higher rates and have been feeling that rates would go up even with a weak economy. Whether that is true or not will probably be resolved in the next couple of weeks.

The Passion

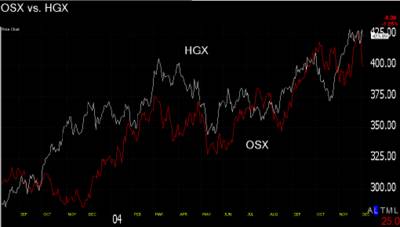

That said, I would be very wary of stepping into the oil or metals sector here. There seems to be a lot of rolling rationalization going on about 50 yr trends due to the printing of dollars and the general availability of commodities. Even if the dips are opportunities it is better to let the market base out and begin to feel strong again. Some of the industrial commodity companies may still be good shorts in here. Take a look at the chart of IST as it is not down nearly as much as the XAU or OSX. It also feels like the current commodity selloff will morph into real fears about Chinese growth.

The dollar is getting a long overdue bounce. I hope somebody was able to participate in it. Do you think it will bounce high enough that people will doubt that the U.S. deficit guarantees a weaker dollar?

Public Debt

"In regard to public debt, governments do not pledge their own assets, but taxpayers' instead, with creditors cognizant that the principle and interest will be paid through the involuntary confiscation of private property - —taxation. In effect, both sides are complicit in the violation of property rights of a third party in the future, which scarcely deserves to be acknowledged as a contract."

The quote struck me because of all the recent talk about the U.S. deficit and how little willingness there is to fix the problem.

The article is also a good read because Argentina has a mountain of debt and from the looks of things there will be several months of erratic headlines about how the country resolves its obligations with creditors.

Deficit Management

This ties in pretty well with the points I made last week.

Dec 7, 2004

Failing

Oil Top Off

Morning Story

Equities continue trying to behave as though we are in the Spring of '03 but these shifts going on in the bond market seem very different. Except for China the world is growing more slowly than anyone would like and Europe, Japan and the U.S. are trying to boost activity with stimulative rates. Currently it looks as though the U.S. is going to be forced out of that game as markets take U.S. rates up. The upside is that the bond shifts are forcing the U.S. currency lower which will have a longer term stimulative effect. Maybe over the long run it is a zero sum game for the economy but in the short run the real currency losses in the markets will create sellers and weakness.

Lastly I wanted to point out the McClellan oscillator (chart) is behaving very oddly here, dripping off the right side of the chart while the indices float higher. This indicator tracks the market breadth and is reflecting a narrowing rally. In the few years I have been watching this indicator markets have always responded very quickly such deterioation but this time feels different. I was away from the market during 99 (which rallied for months with failing breadth) and will need to do some research but I point it out as a notable developement of the last couple days.

**added at 11:00 AM

The breadth is negative again despite this AM's strength. The relationship that has existed between the breadth and market really appears to be diverging here. It feels a lot like the trend is shifting and the breadth will no longer be the indicator it has been.

Dec 6, 2004

Question of the Day

The breadth has stayed solidly negative all day which is a bit hard to get used to considering how consistently that indicator has agreed with the close over the last year. Not sure it means anything and in general a nothing day which counts as trend continuation.

No Buyers?

Mulling It Over

Of course the market is still lower after a new high on Friday and Circuit City is wrecking somebody's Christmas so a slow start to a deeper pullback could be just what the doctor ordered.

Watching the weakness in commodity stocks and comparing that to relatively better performance in their underlying commodities. Along the same lines the dollar bounce seems feeble compared to treasury strength. Lots of people are watching these variables to see whether or not the dollar will collapse now or later but it is tough to take anything away from today's action.

CAO was Short Oil

This news makes it more likely to me that oil has put in a 6 month top.

Quick post

Dec 4, 2004

What the Job report means

I am still pretty sure the bond market has been getting hurt because investors are beginning to look at real returns rather than nominal returns. With the dollar making new lows on the jobs report I think that the trend towards higher yields will reassert itself shortly. The Fed may begin facing political pressures to stop hiking but they need to keep ahead of the currency market which means hiking until positive U.S. economic data gets reflected by dollar strength.

It was interesting that virtually everyone in the market seemed to be expecting a strong jobs report and my best guess for the reason is simply rationalizing the stock market's advance. As I said in my morning post yesterday, the stock market wanted to go up and whatever the numbers were it was going to do so. That sort of rationalization is a sign of euphoria. It is throwing your hands in the air, saying you don't understand the market's strength, and trusting other participants to be better informed about the future of the economy. That mindset will work just as well to justify lower prices.

Dec 3, 2004

Breakdown

Buying those puts back

March Memories

On March 5 the 30-yr opened at a yield of 4.88 which was the high, closed at 4.70, opened March 8th at 4.73 and closed at 4.71. While this went on stocks opened at 1154 hit a high of 1163 and closed at 1156 only to open monday at 1156 and close at 1147. That report marked the end of the great bull market / jobless recovery of 2003.

I don't think we have the same market psychology here as equities only began moving up a month ago but I am surprised the comparison to such a significant day in recent history is not being made.

The u-report on March 5th showed an addition of only 21,000 jobs while the market was looking for 125,000 jobs to be added.

A chart for your thoughts.

Click on the chart to see a larger image!!

Here is a graph representing what I said about housing stocks. Some appear to be buying the dollar selloff this AM so maybe my rational will not work out. I was just commenting off the cuff but the chart shows a stronger relationship between the two sectors than I would have imagined.

It is almost as if there is some mystical force (Fed Funds!! Fed Funds!!) driving tangible assets up together.

Something to watch

The next question is...

I would bet bonds have already seen their best levels of the day but it probably depends on the short base.

Jobs report

The biggest impact of a weak report would be to stem the slide in bonds.

But I don't really expect a weak report. I will say the strong side of expected with rates and stocks both going up.

Faber Speaks

"So the demand side is very strong, the incremental demand lead to rise in oil price as you can see. By the way, in your lifetime you won’t see oil at $12 a barrel again ever. That is finito, over.

Now we had some inventory accumulation this year, In the first nine months the Chinese imported 34% more oil than last year. I think they didn’t need 34% more oil so there has been some inventory accumulation. So oil prices could easily, in my opinion, go anywhere between $30- $40 in the months ahead when growth slows down, but the trend is definitely for oil demand in Asia to rise as people go from the bicycles to the motorcycles to the cars. Once they move from the countryside to the cities they need the refrigerators, they need transportation, heaters and so forth and so energy demands rises a lot. " - Mark Faber

China

I would expect commodity weakness will continue. Oil and the oil stock may need to wait a good 6-9 months before challenging recent highs. I would be very patient in that sector here.

The Promised Land

He paints an excellent picture of the positive things going on around the world that can more than offset the problems with the core economies. The problem is really one of timing. The core economies of Japan, Europe, the U.S. and China seem more intent on bickering and finger pointing than on actually making positive changes within' their own countries.

With the dollar having begun its descent while interest rates in the U.S. float higher it is probably too late for changes to be made. Sometimes it takes a catastrophe or near catastrophe to spur real policy changes and that is what will ultimately unwind the U.S. debt problem.

Thunderbird 1.0

Dec 2, 2004

Full Disclosure

"The revelation, made in an affidavit by Chen Jiulin, CAO's suspended chief executive, to Singapore's High Court, will heighten concerns over insider trading, lax corporate governance and poor disclosure at Chinese groups listed on international exchanges."

"The court document, submitted on Monday and obtained by the Financial Times, says that CAO has received payment demands totalling more than $247.5m from seven financial institutions including Goldman Sachs, Barclays Capital, Standard Bank and Mitsui & Co."

"On October 20, CAOHC reduced its stake from 75 to 60 per cent, raising S$196m ($120m) through a share placement to investors, believed to be mostly hedge funds. At the time, CAO issued an eight-line statement to the Singapore exchange reporting the placement without specifying the reason for the share sale. On the same day, a CAO spokesperson told Bloomberg the parent "had an investment they are making and they need to raise the cash"."

The issue was brought by Deutsche bank.

Current interest rate trends

More China thoughts

I want to reiterate my thoughts on the disconnect between what people know about China and what people think they know. That country is an anomaly in the world today with virtually zero transparency on any subject and least of all on its financial situation. People that live in China are not allowed to read the news unfiltered and if you remember SARS you remember that the official reaction was to lie, lie and lie some more. The Chinese government is living in a time machine and most of the world, for whatever reason, either does not know that China is different or chooses to ignore that fact.

The implications of this are absolutely huge if you are a company like GM and have bet a large portion of you companies growth on China. My first thought on reading about CAO was to the Bre-x gold scandal. The net effect in the short-run will be that risk managers will perform due diligence on every similar counter-party in the region and I doubt that process will lead to increased lines for anyone.

Right on Oil but...

Taking stops in metal stocks today.

Notice that bonds continue weakening. U.S. equities are responding positively to the impact of lower oil but ignoring the drag of higher rates. Interest rates have been in a wide uptrend since April '03 and it will be interesting to see if the markets can tolerate rates making new highs.

The dollar is seeing its first real bounce in a while. I guess people are leaning towards a strong

unemployment report but that did not help the dollar last month.

Shake it up?

China Aviation Oil, one of Singapore's top China-related listings, sought court protection after running up the loss trading oil derivatives. The loss amounted to more than CAO's market value." - FT.

My guess is that this will really pummel oil tomorrow. It could have a broader effect on Asian shares or even banking shares here. My best guess though is that the market is too bulled up to get pulled down and any negative effect will be offset if oil does come off.

Dec 1, 2004

Dollar Woes

With the renewed strength in equities and the drop in oil it is probably a sign that we have finished a countertrend period for markets. While the dollar did not get a bounce, accelerating weakness would confirm that idea. Could lead to strength in metals tomorrow.

Banner Day

This rally is impressive and feels well timed to avoid a pullback. I guess the market is willing to ignore higher interest rates and bad retail sales (auto sales too!) if we get stimulation via falling oil prices. While I like trading momentum patterns in individual stocks I am horrific at trading momentum in the market indices. Not sure if it is a short coming or a good defense mechanism but I find it very difficult to buy with higher prices as my only catalyst and a large crowd of people lined up the same way.

The metal equities seem pretty weak here compared to both the underlying metals and the dollar. I am guessing it is due to the arrival of the gold ETF (GLD) which essentially targets investors who don't trade metals or futures. Some people are pointing to the way metal equities led the metal declines earlier this year but I think this time will be different. We shall see.

Stopped out

Part of me feels like this top is just a bit difficult to time, like all the other tops this year, but with the breakout above the downtrend line in Nov. it is difficult to play that way.